Running a business is challenging enough without wrestling with generic bookkeeping solutions that don’t fit your industry’s unique needs. At Rocket Bookkeeper, we understand that a restaurant’s financial tracking looks vastly different from a freelancer’s income streams or a nonprofit’s fund accounting. That’s why we’ve created this comprehensive guide to help you navigate industry-specific bookkeeping requirements and find solutions that actually work for your business.

Why Industry-Specific Bookkeeping Matters

Before diving into specific industries, let’s address the elephant in the room: Why can’t you just use any bookkeeping system? The truth is, every industry has its own financial quirks, compliance requirements, and reporting needs. A one-size-fits-all approach often leads to missed deductions, compliance issues, and hours of frustration trying to make square pegs fit into round holes.

Online Bookkeeping for E-commerce

E-commerce businesses face unique challenges that traditional bookkeeping wasn’t designed to handle. Between managing inventory across multiple platforms, tracking shipping costs, handling payment processor fees, and dealing with returns and refunds, your financial records can quickly become a tangled mess.

Key E-commerce Bookkeeping Needs:

- Multi-channel sales reconciliation (Amazon, Shopify, eBay, Etsy)

- Real-time inventory management and cost of goods sold (COGS) tracking

- Payment gateway integration (Stripe, PayPal, Square)

- Sales tax compliance across multiple jurisdictions

- Marketplace fee tracking and reconciliation

- Return and refund management

- Accurate profit margin calculations per product

Pro Tip: Your e-commerce bookkeeping system should automatically sync with your selling platforms to avoid manual data entry nightmares. Look for solutions that handle SKU-level tracking and provide real-time inventory valuation.

Online Bookkeeping for Freelancers

Freelancing offers incredible freedom, but it also means you’re wearing every business hat – including the bookkeeper’s visor. As a freelancer, your bookkeeping needs to be simple yet comprehensive enough to handle project-based income, estimated tax payments, and deductible expenses.

Essential Freelance Bookkeeping Features:

- Invoice creation and payment tracking

- Project-based income and expense allocation

- Mileage and home office deduction tracking

- Quarterly estimated tax calculations

- Client payment history and accounts receivable management

- 1099 preparation and contractor payments

- Time tracking integration for billable hours

- Separate business and personal expense management

Pro Tip: Set aside 25-30% of each payment for taxes immediately. Your future self will thank you when quarterly estimated taxes are due.

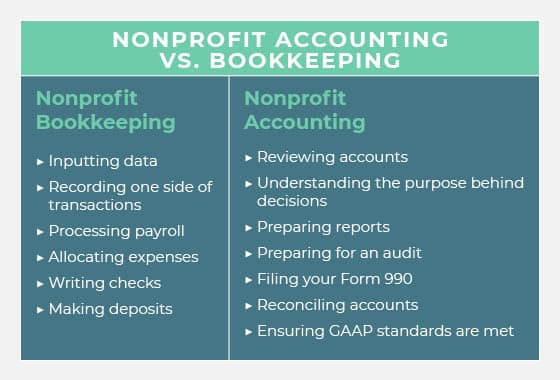

Bookkeeping for Nonprofits Online

Nonprofit bookkeeping isn’t just different – it operates under an entirely different framework called fund accounting. Instead of tracking profits, you’re managing restricted and unrestricted funds, tracking program expenses, and maintaining donor accountability.

Nonprofit-Specific Bookkeeping Requirements:

- Fund accounting and grant management

- Donor contribution tracking and acknowledgment

- Program expense allocation and reporting

- Form 990 preparation support

- Restricted vs. unrestricted fund management

- In-kind donation valuation and recording

- Budget vs. actual reporting for board meetings

- Compliance with FASB standards (ASC 958)

Pro Tip: Transparency is everything in the nonprofit world. Your bookkeeping should make it easy to show donors exactly how their contributions are being used and demonstrate your organization’s impact.

Online Bookkeeping for Restaurants

Restaurant bookkeeping is notoriously complex. You’re juggling perishable inventory, tip reporting, high employee turnover, thin profit margins, and daily cash reconciliation. Miss a step, and your financial picture becomes about as clear as day-old soup.

Critical Restaurant Bookkeeping Elements:

- Point-of-sale (POS) system integration

- Recipe costing and menu engineering support

- Tip allocation and payroll management

- Liquor inventory and compliance tracking

- Daily sales reconciliation

- Vendor payment scheduling and food cost analysis

- Labor cost percentage monitoring

- Waste and spoilage tracking

Pro Tip: Track your prime costs (food costs + labor costs) religiously. This single metric should ideally stay below 60% of your sales and is the best indicator of your restaurant’s financial health.

Online Bookkeeping for Real Estate Agents

Real estate agents deal with commission-based income, transaction-heavy accounting, and significant deductible expenses. Your bookkeeping needs to handle irregular income patterns while tracking dozens of potential tax deductions.

Real Estate Agent Bookkeeping Essentials:

- Commission income tracking and split management

- Transaction-by-transaction profit analysis

- MLS fees and licensing expense tracking

- Marketing and advertising expense categorization

- Vehicle mileage and travel expense logging

- Home office deduction calculation

- Escrow account management (for brokers)

- 1099 form preparation for contractors

Pro Tip: Save receipts for everything – from open house supplies to client gifts. Real estate agents typically have 50+ deductible expense categories, and proper tracking can save thousands in taxes.

Online Bookkeeping for Healthcare Providers

Healthcare practices face stringent compliance requirements, insurance billing complexities, and patient privacy regulations that extend to financial records. Your bookkeeping must be HIPAA-compliant while handling the unique aspects of medical billing.

Healthcare Bookkeeping Priorities:

- Insurance claim tracking and accounts receivable management

- Patient billing and payment plan monitoring

- Medical supply inventory and pharmaceutical tracking

- Credentialing and licensing fee management

- Malpractice insurance and liability tracking

- HIPAA-compliant financial record keeping

- Provider compensation and profit-sharing calculations

- Medical equipment depreciation

Pro Tip: Keep a close eye on your days in accounts receivable (A/R). Healthcare practices often carry 45-60 days of revenue in outstanding claims, which can strain cash flow if not managed properly.

Online Bookkeeping for Construction Companies

Construction bookkeeping requires job costing expertise, progress billing management, and the ability to track profitability across multiple simultaneous projects. You’re also dealing with subcontractors, materials across job sites, and retention accounting.

Construction Bookkeeping Must-Haves:

- Job costing and project-based accounting

- Progress billing and AIA billing format support

- Subcontractor management and 1099 tracking

- Material cost allocation across projects

- Equipment depreciation and rental tracking

- Retention receivable and payable management

- Change order documentation and tracking

- Prevailing wage compliance (for government contracts)

- Work-in-progress (WIP) reporting

Pro Tip: Implement job costing from day one. Knowing which types of projects are actually profitable (versus which ones just keep you busy) is the difference between thriving and merely surviving in construction.

Industry-Specific Bookkeeping Software

Choosing the right bookkeeping software for your industry can dramatically reduce your administrative burden and improve financial accuracy. Here’s how to evaluate options:

What to Look For:

- Native integrations with your industry-specific tools (POS systems, practice management software, project management platforms)

- Built-in compliance features for your industry’s regulations

- Reporting templates designed for your business type

- Scalability as your business grows

- Mobile accessibility for on-the-go management

- Automation features to reduce manual data entry

- Customer support that understands your industry

Popular Industry-Specific Solutions:

- E-commerce: A2X, QuickBooks Commerce, Xero (with e-commerce add-ons)

- Construction: Sage 300 CRE, Foundation Software, Viewpoint

- Healthcare: AdvancedMD, Kareo, athenaCollector

- Restaurants: Toast, TouchBistro, Restaurant365

- Nonprofits: QuickBooks Nonprofit, Aplos, Blackbaud Financial Edge

Online Bookkeeping Templates by Industry

Templates can be lifesavers when you’re building your bookkeeping system. The right template gives you a head start with pre-configured accounts, reports, and workflows tailored to your industry.

Essential Templates to Consider:

- Chart of accounts customized for your industry

- Monthly financial statement templates

- Budget templates with industry benchmarks

- Cash flow projection worksheets

- Invoice templates that meet industry standards

- Expense tracking spreadsheets with relevant categories

- Tax deduction checklists specific to your business type

- Year-end closing checklists

Pro Tip: Don’t just download a template and call it done. Customize it to reflect your unique business model, adding or removing categories as needed. Your bookkeeping system should work for you, not the other way around.

Bookkeeping for Startups Online

Startup bookkeeping requires a different mindset. You’re not just tracking what happened – you’re building financial systems that will scale with your growth while satisfying investor reporting requirements.

Startup Bookkeeping Foundations:

- Clean separation of personal and business finances

- Equity and cap table management

- Burn rate and runway calculations

- Investor reporting and dashboard creation

- Revenue recognition (especially for SaaS and subscription models)

- R&D expense tracking for potential tax credits

- Funding round documentation and tracking

- Budget vs. actual variance analysis

- Key performance indicator (KPI) integration

Pro Tip: Even if you’re pre-revenue, maintain proper books from day one. Investors will conduct financial due diligence, and messy books can kill deals or significantly reduce your valuation.

Startup-Specific Considerations:

- Accrual accounting vs. cash accounting decisions

- Deferred revenue management for subscription businesses

- Stock option expense recording

- Convertible note and SAFE agreement tracking

- Multi-currency handling for international operations

Making the Transition to Online Bookkeeping

Ready to implement industry-specific online bookkeeping? Here’s your action plan:

Step 1: Assess Your Current Situation Take stock of what’s working and what’s not in your current bookkeeping process. Identify pain points specific to your industry.

Step 2: Define Your Requirements List must-have features based on your industry needs. Don’t just think about today – consider where your business will be in 2-3 years.

Step 3: Research Solutions Look for bookkeeping software and services that specialize in your industry. Read reviews from businesses similar to yours.

Step 4: Start with Clean Data If you’re migrating from another system, clean up your data before the transition. Garbage in, garbage out applies doubly to bookkeeping.

Step 5: Get Professional Help Consider working with a bookkeeper or accountant who specializes in your industry, at least during the setup phase.

The Rocket Bookkeeper Advantage

At Rocket Bookkeeper, we don’t believe in cookie-cutter solutions. We understand that your industry has specific needs, challenges, and opportunities. Whether you’re selling products online, treating patients, building homes, or changing the world through your nonprofit, we help you implement bookkeeping systems that work with your business, not against it.

Our industry-specific expertise means we speak your language, understand your pain points, and know exactly which metrics matter most for your success. We don’t just track numbers – we provide the financial clarity you need to make confident business decisions.

Ready to take your bookkeeping to the next level? Let’s build a system that actually fits your business.

Final Thoughts

The right bookkeeping approach isn’t just about staying compliant or making tax time easier (though those are nice bonuses). It’s about having clear, accurate financial information that helps you run your business better. When your bookkeeping is tailored to your industry, you can focus on what you do best – serving your customers, clients, or community – while your finances take care of themselves in the background.

Don’t settle for generic bookkeeping solutions that make you work harder. Invest in industry-specific approaches that work smarter, and watch how much easier financial management becomes.

Your financial clarity starts here. Your industry expertise matters. Your success is our mission.