Managing your business finances can feel like a constant juggling act. Between tracking expenses, sending invoices, and preparing for tax season, the paperwork can quickly pile up. But what if there was a way to streamline these tasks, save time, and gain clearer financial insights? This is where online bookkeeping comes in. By moving your financial management to the cloud, you can unlock powerful advantages that help your business thrive.

Let’s explore the key benefits of online bookkeeping and how it transforms financial management for modern businesses. We’ll cover everything from cost savings and enhanced security to real-time data access that empowers smarter decision-making.

What is Online Bookkeeping?

Online bookkeeping, also known as cloud-based accounting, uses specialized software to manage your financial records over the internet. Instead of using desktop software installed on a single computer or relying on paper ledgers, your financial data is stored securely in the cloud.

This setup allows you and your bookkeeper to access, update, and collaborate on your financial information from anywhere with an internet connection. It centralizes everything—from bank transactions and payroll to accounts payable and receivable—into one accessible digital hub. This is a significant upgrade from traditional methods that often lead to data silos, delays, and costly errors.

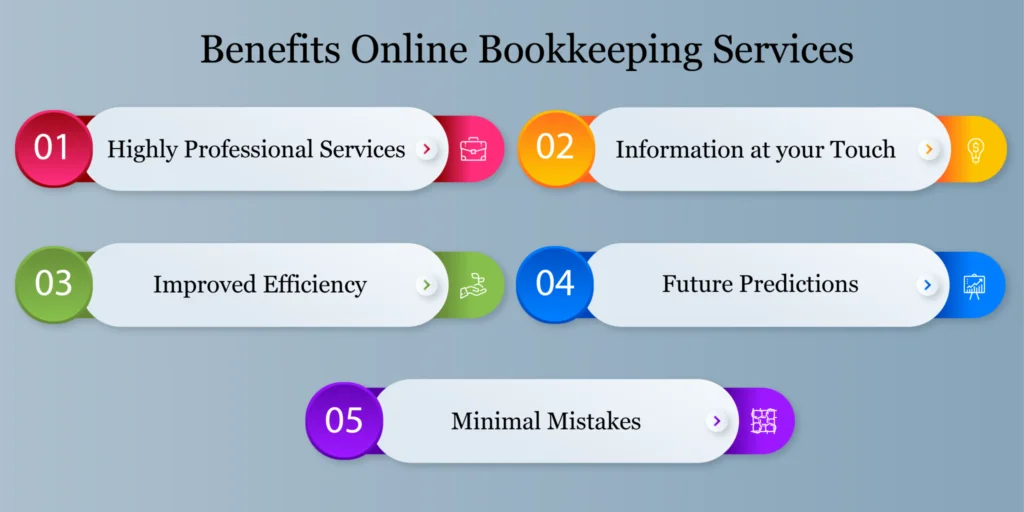

Key Benefits for Your Business

Switching to an online bookkeeping service like Rocket Bookkeeper offers more than just convenience. It provides tangible benefits that can directly impact your bottom line and operational efficiency.

1. Access Your Financial Data Anytime, Anywhere

One of the most significant advantages of online bookkeeping is the freedom it provides. You are no longer tied to a specific office or computer to view your financial health.

Whether you’re traveling for a conference, working from home, or meeting with a potential investor, you can log into your account from a laptop, tablet, or smartphone. This immediate access allows you to check cash flow, review recent expenses, or pull up a profit and loss statement on the spot. This level of accessibility ensures you always have the information you need to make timely, informed decisions.

2. Improve Collaboration with Your Team and Accountant

Online bookkeeping platforms are built for collaboration. You can grant secure access to your accountant, business partners, or internal team members. Everyone works from the same set of data, which eliminates confusion caused by multiple spreadsheet versions or outdated files.

Your bookkeeper can reconcile accounts, categorize transactions, and generate reports in real-time. If you have a question about a specific entry, you can both look at the same digital document simultaneously, making communication faster and more effective. This seamless partnership helps you get more value from your financial professional, who can focus on providing strategic advice instead of chasing down paperwork.

3. Automate Repetitive Tasks and Save Time

How much time do you spend on manual data entry, bank reconciliation, or chasing late payments? Online bookkeeping software automates many of these time-consuming tasks.

You can set up rules to automatically categorize recurring expenses, sync your bank and credit card feeds to import transactions, and schedule recurring invoices. Many systems also offer automated payment reminders to help you improve your accounts receivable turnover. By letting the software handle the tedious work, you and your team can reclaim valuable hours to focus on core business activities like sales, customer service, and strategic growth.

4. Enhance Data Security and Reduce Risk

Storing sensitive financial data on a local hard drive or in a filing cabinet carries significant risks. Laptops can be stolen, hard drives can fail, and physical documents can be lost or damaged in a fire or flood.

Reputable online bookkeeping services use advanced security measures to protect your information. This includes data encryption, multi-factor authentication, and regular backups on secure servers. These protocols are often more robust than what a small business can implement on its own. With cloud-based accounting, your financial data is protected from physical theft and digital threats, giving you greater peace of mind.

5. Gain Real-Time Financial Insights

With traditional bookkeeping, you often have to wait until the end of the month or quarter to get a clear picture of your financial performance. By then, it might be too late to address a cash flow issue or capitalize on a new opportunity.

Online bookkeeping provides a live, dynamic view of your finances. Interactive dashboards display key performance indicators (KPIs) like revenue, expenses, and net profit at a glance. You can run up-to-the-minute reports to analyze trends, monitor your budget, and understand your financial position right now. This real-time visibility empowers you to be proactive rather than reactive in managing your business.

6. Scale Your Financial Operations with Ease

As your business grows, your financial needs become more complex. You may need to manage more transactions, hire employees, or track inventory. Online bookkeeping systems are designed to scale with you.

Most platforms offer different subscription tiers and integrations, allowing you to add features like payroll processing, time tracking, or project management as you need them. This flexibility means you won’t outgrow your system. You can easily adapt your financial toolkit to support your business at every stage of its growth, from a solo startup to a thriving enterprise.

Make the Smart Switch with Rocket Bookkeeper

The move to online bookkeeping is a strategic investment in your business’s future. It streamlines operations, enhances security, and provides the critical insights needed for sustainable growth. By leveraging the power of the cloud, you can transform your financial management from a burdensome chore into a powerful business asset.

At Rocket Bookkeeper, we specialize in helping businesses like yours make a seamless transition to online bookkeeping. Our expert team combines cutting-edge technology with personalized service to deliver accurate, timely, and actionable financial data. Let us handle the numbers so you can focus on what you do best—running your business.