Filing taxes can feel overwhelming, especially when multiple income sources and deductions are involved. That’s where Schedule 1 (Form 1040) comes in. At Rocket Bookkeeper, we help simplify the process so you don’t miss important details that could affect your tax liability or refund.

What Is Schedule 1 (Form 1040)?

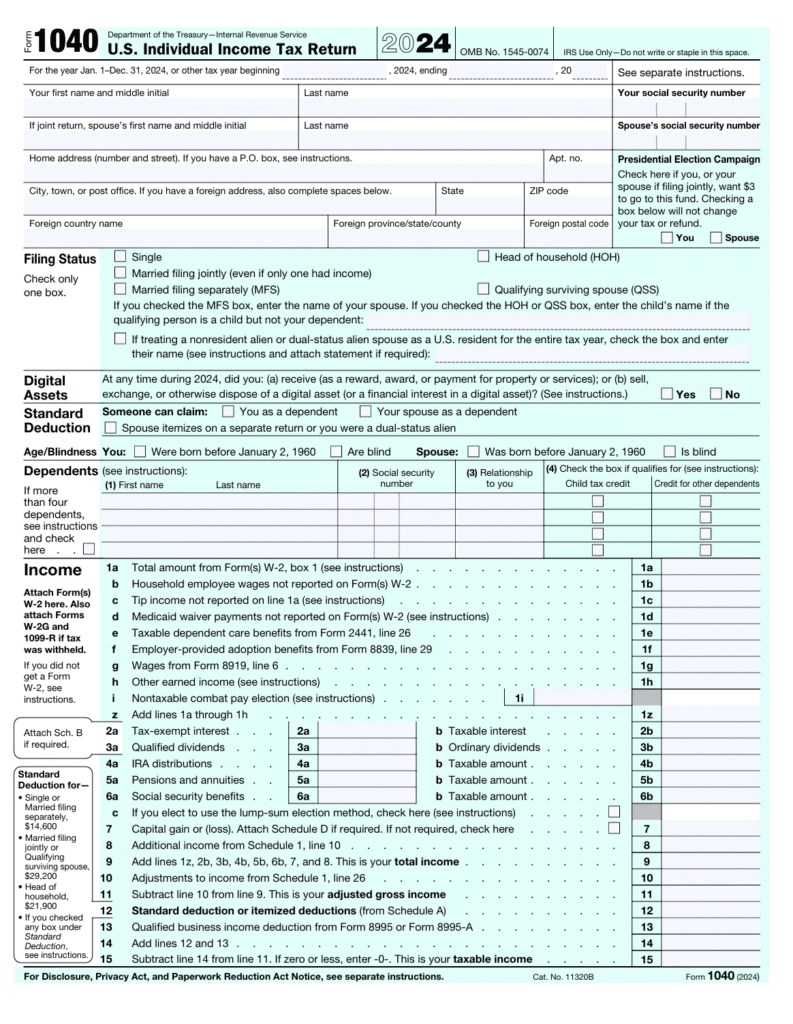

Schedule 1, officially called “Additional Income and Adjustments to Income,” is an add-on to the standard Form 1040 used in U.S. federal tax filings. Not everyone needs it — but if you have additional income streams or special adjustments, this form becomes essential.

Schedule 1 covers:

- Extra income such as business, freelance, rental, or unemployment earnings.

- Adjustments to income like student loan interest, retirement plan contributions, educator expenses, and Health Savings Account (HSA) deductions.

By accurately completing Schedule 1, taxpayers can ensure their Adjusted Gross Income (AGI) is calculated correctly, unlocking potential deductions and credits.

Key Takeaways (Rocket Bookkeeper Insights)

- Covers more than your paycheck: Report side hustles, freelance gigs, or rental properties.

- Adjustments save money: Deductions lower your AGI, reducing taxable income.

- Supports additional credits: Schedule 1 ties into credits like the Additional Child Tax Credit or education credits.

- Big-picture tax view: It helps create a comprehensive snapshot of your finances for the IRS.

At Rocket Bookkeeper, our team ensures every line is accurate so you maximize deductions and stay compliant.

When Do You Need Schedule 1?

You may need to file Schedule 1 if:

- You earned self-employment or freelance income.

- You collected unemployment benefits.

- You have rental property income.

- You received partnership or S-corp distributions.

- You qualify for adjustments like HSA contributions, educator expenses, or IRA deductions.

- You’re claiming credits such as the Adoption Credit, American Opportunity Credit, or Lifetime Learning Credit.

Not every taxpayer files Schedule 1, but if you fall into these categories, leaving it out could cause errors or delays in your return.

Benefits of Filing Schedule 1

At Rocket Bookkeeper, we see Schedule 1 as an opportunity to:

- Report every income stream correctly (avoiding IRS penalties).

- Take advantage of above-the-line deductions like student loan interest or self-employed health insurance.

- Unlock valuable tax credits that reduce your overall tax bill.

- Lower your taxable income by adjusting for retirement contributions or HSA deposits.

- Stay compliant with foreign income/tax reporting if applicable.

Step-by-Step: How to Complete Schedule 1

Step 1: Collect your documents

Gather W-2s, 1099s, rental records, and proof of expenses.

Step 2: Enter personal info

Fill in your name and Social Security number at the top.

Step 3: Report additional income

List all side income — freelance, business, rental, unemployment, gambling winnings, etc.

Step 4: Apply adjustments

Deduct eligible expenses such as:

- Educator supplies (up to $250)

- Student loan interest

- IRA and retirement contributions

- HSA deposits

- Self-employed health insurance

Step 5: Add eligible tax credits

Examples include the Additional Child Tax Credit, Education Credits, and Foreign Tax Credit.

Step 6: Double-check and attach

Review your entries carefully. Attach Schedule 1 to your Form 1040 when filing.

At Rocket Bookkeeper, we streamline this entire process to save you time and stress.

Common Mistakes to Avoid

- Forgetting to report freelance or rental income.

- Overlooking deductions like student loan interest or retirement contributions.

- Making calculation errors.

- Failing to attach Schedule 1 to Form 1040.

- Missing supporting documentation.

Our bookkeeping experts ensure none of these mistakes slip through.

Deadlines

Schedule 1 is filed alongside Form 1040. Standard due dates are:

- April 15 for most taxpayers.

- October 15 if you file for an extension.

Rocket Bookkeeper keeps you on track with reminders and organized documentation.

Why Choose Rocket Bookkeeper?

Taxes don’t have to be stressful. At Rocket Bookkeeper, we:

- ✅ Simplify complex forms like Schedule 1.

- ✅ Maximize deductions and credits so you keep more money.

- ✅ Ensure accuracy to avoid IRS issues.

- ✅ Provide proactive tax planning for long-term savings.

Final Thoughts

Schedule 1 (Form 1040) is more than just paperwork — it’s an opportunity to optimize your taxes. By accurately reporting additional income and adjustments, you gain a clearer financial picture and potentially lower your tax bill.

With Rocket Bookkeeper, you get more than just form preparation. You get a partner who ensures your taxes are filed smarter, faster, and stress-free.

Rocket Bookkeeper — helping you file with confidence.