What Are Pro Forma Financial Statements?

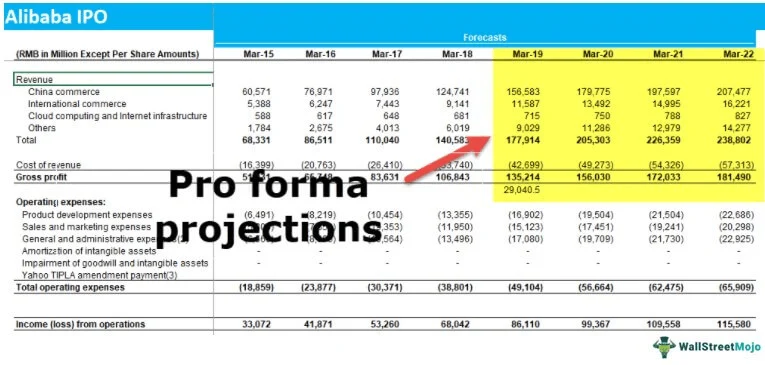

“Pro forma” is a Latin term meaning “for the sake of form”. In accounting and finance, pro forma financial statements are reports based on hypothetical or projected scenarios. Instead of showing your past or current results, they answer the “what if” question.

For example:

👉 What if my business received a $50,000 loan next year?

Your pro forma financial statements would model out how that loan affects your revenue, expenses, and cash flow.

These statements are not GAAP-compliant (since GAAP requires historical accuracy). Instead, they are used for planning, forecasting, and decision-making.

The 3 Major Pro Forma Statements

- Pro Forma Income Statement – Projects future revenues, expenses, and profits.

- Pro Forma Balance Sheet – Projects assets, liabilities, and equity.

- Pro Forma Cash Flow Statement – Projects cash inflows and outflows.

Unlike actual reports, pro forma statements are about potential outcomes. They must always be clearly labeled “pro forma” and cannot be used for tax filing. Misuse (for example, to mislead investors) can result in penalties from the SEC.

Why Businesses Use Pro Forma Statements

Creating pro forma financial statements can help you:

- Secure financing → Show lenders or investors how additional capital will impact growth.

- Plan for the future → Forecast best-case, worst-case, and most likely scenarios.

- Anticipate changes → See how new expenses, acquisitions, or tax bracket changes could affect your company.

- Test strategy → Evaluate if a new hire, location, or equipment purchase will be financially sustainable.

In short, pro forma statements let you “test-drive” the future before committing to big decisions.

Pro Forma Statements vs. Budgets

It’s easy to confuse budgets with pro forma statements, but they serve different purposes:

- Budget = Plan → How you intend to allocate money.

- Pro Forma Statement = Prediction → What your financials might look like under certain scenarios.

💡 Example: If your current income is $37,000 and your pro forma projects $44,000 for next year, you might create a budget that plans how to use the extra $7,000 (e.g., $4,000 to pay down debt and $3,000 to savings).

Types of Pro Forma Financial Statements

1. Full-Year Pro Forma Projection

Projects actual results for part of the year, plus forecasts for the remaining months. Helps investors and partners visualize end-of-year financial health.

2. Financing or Investment Pro Forma

Models how outside capital (loans, equity investments) will affect business operations, interest obligations, and growth.

3. Historical with Acquisition Pro Forma

Combines your business’s past financials with those of a target company to show how a merger or acquisition could impact future results.

4. Risk Analysis Pro Forma

Models best-case and worst-case scenarios. Example: What if your supplier raises prices by 15%? or What if equipment costs rise?

Pro Forma Templates You Can Use

Pro forma statements use the same structure as normal financial statements. Here are simple templates:

- Income Statement Template – Revenue – COGS – Expenses = Net Income

- Balance Sheet Template – Assets = Liabilities + Equity

- Cash Flow Statement Template – Inflows – Outflows = Net Cash

(Tip: At Rocket Bookkeeper, we can prepare professional pro forma statements for your small business with accurate, customized templates.)

How to Create a Pro Forma Statement

Pro Forma Income Statement (Step-by-Step)

- Set sales goals (e.g., increase revenue by $18,000 next year).

- Map a production/sales schedule to reach your goal.

- Estimate costs of goods sold (COGS).

- Include operating expenses (rent, utilities, salaries, etc.).

- Prepare the pro forma statement using your assumptions.

✅ Accuracy tip: Always use up-to-date bookkeeping records. Without accurate historical data, your forecasts may be unrealistic.

Example: Pro Forma Income Statement

Rosalia’s Reliable Recordings

| Year | 2021 (Actual) | 2022 (Pro Forma) | 2023 (Pro Forma) |

|---|---|---|---|

| Sales Revenue | $20,000 | $38,000 | $48,000 |

| Cost of Sales | (10,000) | (19,000) | (24,000) |

| Gross Profit | 10,000 | 19,000 | 24,000 |

| Operating Expenses | (4,600) | (5,600) | (6,600) |

| Net Income | $5,400 | $13,400 | $17,400 |

Pro Forma Cash Flow Statement (Step-by-Step)

- Start with beginning cash balance.

- Add projected cash inflows (sales, loans, donations, etc.).

- Subtract projected outflows (expenses, taxes, loan repayments).

- Calculate net cash flow and closing balance.

Example: Pro Forma Cash Flow

Mickie’s Murakami Museum

| Year | 2021 | 2022 | 2023 |

|---|---|---|---|

| Opening Balance | $16,000 | $17,000 | $19,000 |

| Cash Inflows | 86,000 | 87,900 | 92,800 |

| Cash Outflows | (66,000) | (68,600) | (69,800) |

| Net Cash Flow | 20,000 | 19,300 | 23,000 |

Pro Forma Balance Sheet (Step-by-Step)

- Start with current assets and liabilities.

- Project changes (loan repayments, savings, equipment purchases).

- Balance Assets = Liabilities + Equity.

Example: Pro Forma Balance Sheet

Daily Dumpling Deliveries

| Year | 2021 | 2022 | 2023 |

|---|---|---|---|

| Assets | $89,000 | $99,000 | $110,000 |

| Liabilities | 71,000 | 64,000 | 61,000 |

| Equity | 80,000 | 91,000 | 100,000 |

How Rocket Bookkeeper Helps with Pro Forma Statements

At Rocket Bookkeeper, we specialize in helping small businesses:

✅ Maintain accurate bookkeeping so forecasts are realistic.

✅ Prepare professional pro forma statements for investors or lenders.

✅ Create financial forecasts to support growth and strategic decisions.

✅ Provide ongoing bookkeeping + payroll + tax-ready reporting.

When your financials are accurate, your pro forma statements become powerful tools for decision-making and financing.

Final Takeaway

Pro forma financial statements aren’t just “what if” exercises—they’re essential planning tools for small business owners. Whether you’re seeking financing, planning for expansion, or preparing for risks, pro forma statements give you clarity.

👉 With Rocket Bookkeeper, you’ll always have reliable numbers, expert support, and professional reports that help you plan your future with confidence.