A pro forma balance sheet is a financial statement that projects your company’s assets, liabilities, and equity at a future point in time. Unlike a historical balance sheet, which shows where your business stands today, a pro forma version answers the question:

👉 “What will my balance sheet look like if a certain event happens?”

For example:

- What if you take out a $100,000 loan?

- What if you purchase new equipment worth $25,000?

- What if you acquire another business?

Your pro forma balance sheet will show the effect of those changes on your assets, liabilities, and owner’s equity.

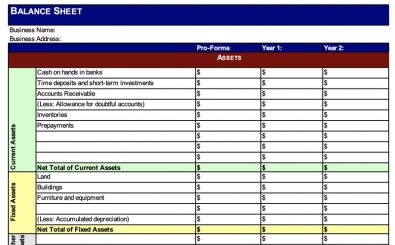

Key Components of a Pro Forma Balance Sheet

Just like a standard balance sheet, it includes:

- Assets

- Current Assets (cash, accounts receivable, inventory)

- Non-Current Assets (equipment, property, vehicles, long-term investments)

- Liabilities

- Current Liabilities (accounts payable, short-term loans, line of credit)

- Non-Current Liabilities (long-term debt, mortgages, bonds payable)

- Equity

- Owner’s capital contributions

- Retained earnings

And it still follows the fundamental rule:

📌 Assets = Liabilities + Equity

🚀 Example of a Pro Forma Balance Sheet

Let’s imagine a small business called Daily Dumpling Deliveries preparing for expansion.

| Balance Sheet Items | 2021 (Current) | 2022 (Pro Forma) | 2023 (Pro Forma) |

|---|---|---|---|

| Assets | |||

| Checking Account | $13,000 | $16,000 | $19,000 |

| Savings Account | $35,000 | $41,000 | $45,000 |

| Accounts Receivable | $4,000 | $2,000 | $2,000 |

| Inventory | $14,000 | $17,000 | $21,000 |

| Total Current Assets | 66,000 | 76,000 | 87,000 |

| Production Equipment | $14,000 | $14,000 | $14,000 |

| Vehicle | $9,000 | $9,000 | $9,000 |

| Total Non-Current Assets | 23,000 | 23,000 | 23,000 |

| Total Assets | 89,000 | 99,000 | 110,000 |

| Liabilities | |||

| Accounts Payable | $10,000 | $9,000 | $11,000 |

| Line of Credit | $21,000 | $19,000 | $18,000 |

| Total Current Liabilities | 31,000 | 28,000 | 29,000 |

| Long-Term Loan | $40,000 | $36,000 | $32,000 |

| Total Liabilities | 71,000 | 64,000 | 61,000 |

| Equity | |||

| Owner’s Capital | $35,000 | $35,000 | $35,000 |

| Retained Earnings | $45,000 | $56,000 | $65,000 |

| Total Equity | 80,000 | 91,000 | 100,000 |

| Total Liabilities & Equity | 151,000 | 155,000 | 161,000 |

✅ Notice how the balance sheet projects changes in debt repayment, growing retained earnings, and higher asset balances as the company expands.

Why Pro Forma Balance Sheets Matter

- They give investors and lenders confidence by showing how new financing will affect your financial position.

- They help owners see if debt repayments and cash reserves are sustainable.

- They’re critical when planning acquisitions, expansions, or large capital purchases.

How Rocket Bookkeeper Helps

At Rocket Bookkeeper, we ensure your pro forma balance sheets are:

- Built on accurate bookkeeping records.

- Structured to highlight your business’s strengths for lenders or investors.

- Customized for realistic financial forecasting.

With clean books and professional reporting, your balance sheet projections won’t just be numbers—they’ll be a powerful roadmap for smarter business decisions.