Table of Contents

- How to Fill IRS Form 1065

- What is Form 1065?

- What Is Form 1065: U.S. Return of Partnership Income?

- How to File Form 1065

- Schedules Overview

- Schedule K

- Schedule L

- Schedule M-1

- Schedule M-2

- Schedule K-1

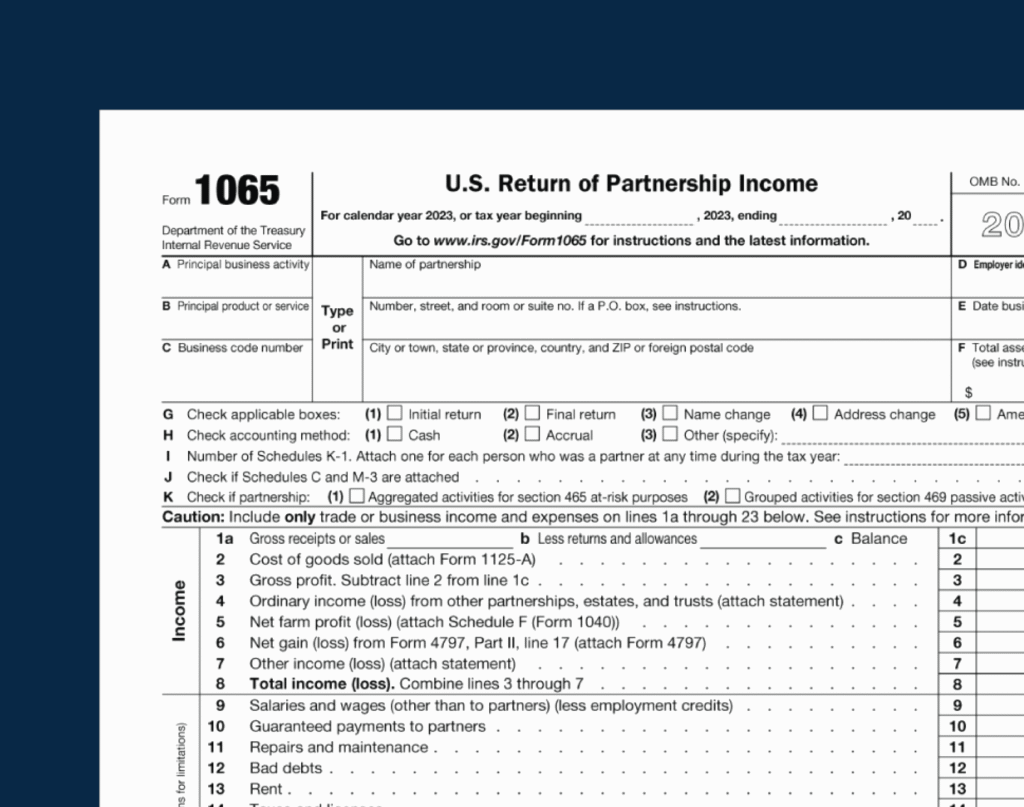

What is Form 1065?

Form 1065, also known as the U.S. Return of Partnership Income, is a tax document issued by the IRS. It is used to report the profits, losses, deductions, and credits of a business partnership. Alongside Form 1065, partnerships are required to file Schedule K-1, which provides detailed information for each partner.

This form gives the IRS a clear picture of the partnership’s financial status for the year. While the partnership itself doesn’t pay income tax, each partner is responsible for reporting and paying taxes on their share of the income, regardless of whether they received distributions.

Key Note:

Schedule K-1 includes details about each partner’s taxable income from passive activities, qualified dividends, net capital gains, and other sources.

How to File Form 1065

Filing Form 1065 requires careful preparation and accurate documentation. Here’s what you’ll need:

- Partnership Agreement: Ensure you have a copy of your partnership agreement, which outlines the distribution of income, losses, and capital among partners.

- Partner Information: Gather details about each partner, including their type (general or limited).

- Financial Records: Prepare year-end financial statements, such as your income statement and balance sheet.

- Tax Details: Have your Employer Identification Number (EIN), NAICS code, and company start date ready.

- Accounting Method: Know your accounting method, gross receipts, and inventory details.

Pro Tip:

Filing Form 1065 can be complex. It’s highly recommended to consult a tax professional or bookkeeping service to ensure accuracy and compliance. Rocket Bookkeeper offers bookkeeping services USA and tax preparation services to simplify this process.

Schedules Overview

Schedule K

This schedule summarizes the partnership’s income, deductions, and credits. It’s essential for calculating each partner’s share of taxable income.

Schedule L

Schedule L outlines the partnership’s balance sheets at the beginning and end of the tax year. It includes details about assets, liabilities, and equity.

Schedule M-1

This schedule reconciles the partnership’s book income with its taxable income. Differences often arise due to varying IRS and partnership accounting methods.

Schedule M-2

Schedule M-2 tracks changes in partners’ capital accounts, including contributions, distributions, and other adjustments. Complete this schedule after filling out Schedules M-1 and L.

Schedule K-1

Each partner must file Schedule K-1, which reports their share of the partnership’s income, deductions, and credits. It also includes details about real estate income, capital gains, foreign transactions, and other relevant items.

Why Choose Rocket Bookkeeper?

At Rocket Bookkeeper, we specialize in USA bookkeeping services, offering tailored solutions for partnerships, small businesses, and real estate investors. Whether you need monthly bookkeeping services, catch-up bookkeeping, or payroll and bookkeeping services near me, we’ve got you covered.

Our team of experienced professionals ensures compliance with IRS regulations while providing accurate and efficient bookkeeping and tax services. From Austin bookkeeping to outsourced bookkeeping services USA, we’re here to simplify your financial management.