Introduction to Net Income

In the world of small business accounting, one of the most important financial numbers you’ll encounter is net income. Also known as net profit, net earnings, or simply the bottom line, it shows how much money your business truly keeps after covering all expenses, taxes, and interest.

At Rocket Bookkeeper, we believe every entrepreneur should understand net income because it is the foundation of financial decision-making, business growth, and long-term sustainability.

What is Net Income?

Net income is the total amount of money left after subtracting all your expenses from your total revenue.

Formula in simple words:

👉 Total Revenues – Total Expenses = Net Income

If the result is positive, your business is profitable. If it’s negative, that means you’re experiencing a net loss.

Fun fact: Accountants used to write profits in black ink and losses in red ink, which is why we still say a business is “in the black” when profitable and “in the red” when losing money.

Why is Net Income Important?

Tracking your net income is not just about taxes — it’s a powerful tool for measuring business health.

- ✅ For business owners: Helps decide whether to cut costs, reinvest profits, or plan for growth.

- ✅ For lenders: Proves your ability to repay loans.

- ✅ For investors: Shows whether you can pay dividends or reinvest into expansion.

At Rocket Bookkeeper, we provide clear monthly reports so you can monitor your net income regularly instead of waiting for tax season surprises.

The Net Income Formula

Here’s the standard formula for net income:

Revenue – Cost of Goods Sold – Expenses = Net Income

Which can also be simplified to:

Gross Income – Expenses = Net Income

Or simply:

Total Revenues – Total Expenses = Net Income

Net income can be calculated for monthly, quarterly, or annual periods depending on your reporting needs.

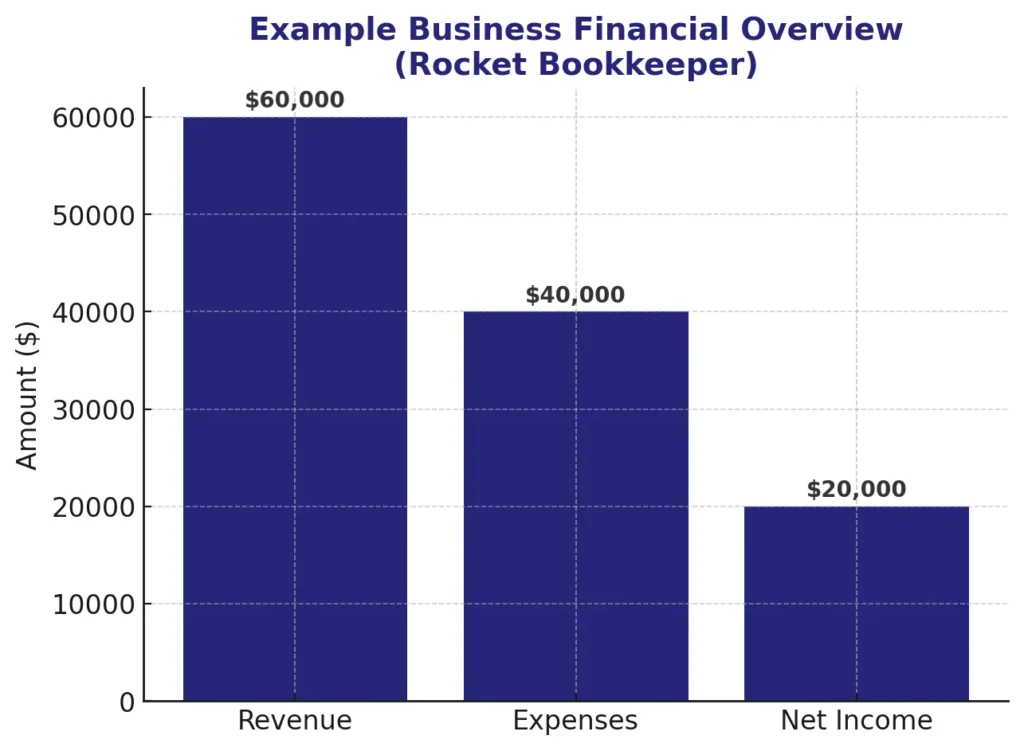

Example: Calculating Net Income

Imagine Wyatt’s Saddle Shop wants to calculate its net income for Q1 of 2023.

- Total Revenue: $60,000

- Cost of Goods Sold (COGS): $20,000

- Rent: $6,000

- Utilities: $2,000

- Payroll: $10,000

- Advertising: $1,000

- Interest: $1,000

Step 1 – Calculate Gross Income:

$60,000 – $20,000 = $40,000

Step 2 – Add Expenses:

$6,000 + $2,000 + $10,000 + $1,000 + $1,000 = $20,000

Step 3 – Calculate Net Income:

$40,000 – $20,000 = $20,000

✅ Wyatt’s shop earned $20,000 in net income for the quarter.

Net Income vs Gross Income

Don’t confuse gross income with net income.

- Gross income = Revenue – COGS (direct costs like raw materials, labor, packaging, shipping).

- Net income = Gross income – All other expenses (rent, payroll, marketing, utilities, taxes, interest).

Think of gross income as the starting point, and net income as the true bottom line.

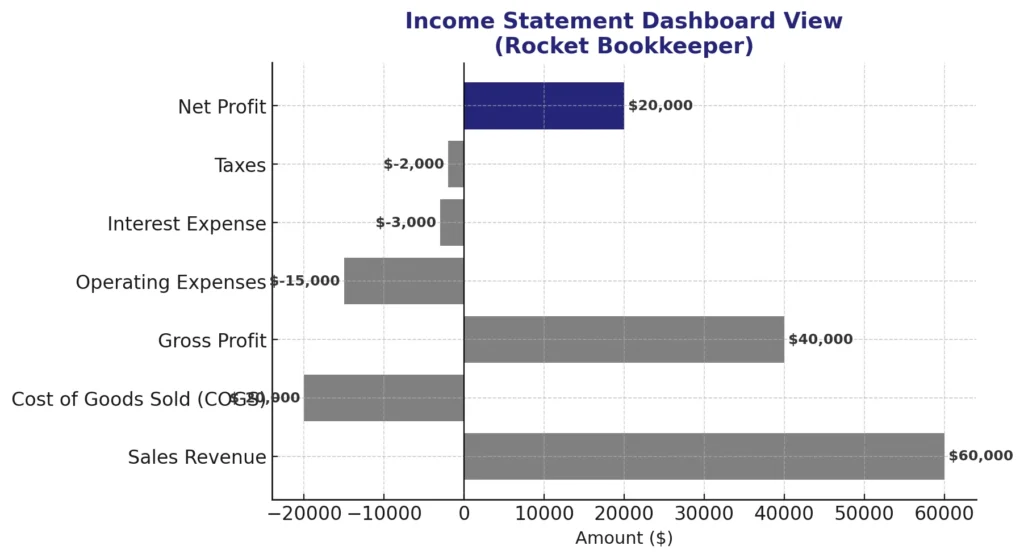

Net Income vs Operating Income

Another useful metric is operating income (also called EBIT: Earnings Before Interest and Taxes).

- Operating income = Gross income – Operating expenses (SG&A costs like salaries, rent, admin, insurance).

- Net income = Operating income – Non-operating expenses (interest, taxes, depreciation).

Lenders and investors often prefer operating income since it focuses only on core operations.

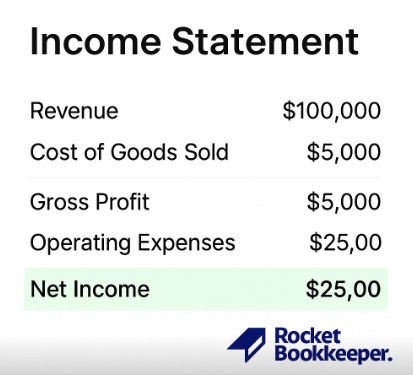

Net Income on the Income Statement

On your income statement (Profit & Loss report), net income is the last line at the bottom — hence the phrase “bottom line.”

Your P&L helps you:

- See how much money flows in and out.

- Track profitability trends over time.

- Make better financial decisions.

At Rocket Bookkeeper, we prepare monthly income statements so you always know your bottom line.

How Rocket Bookkeeper Helps You Track Net Income

Manually calculating net income every month can be stressful. That’s where Rocket Bookkeeper steps in.

We provide:

- Accurate monthly bookkeeping

- Professionally prepared income statements

- Clear insights into net, gross, and operating income

- Guidance on tax planning and expense control

With us handling your books, you can focus on growing your business — while staying confident that your net income is always accurate.

Conclusion

Understanding how to calculate net income is essential for every business owner. It’s not just about compliance — it’s about knowing whether your business is truly profitable.

Whether you’re trying to impress investors, secure a loan, or simply make smarter financial decisions, net income is the key number to watch.

And with Rocket Bookkeeper by your side, you don’t have to calculate it alone.