When analyzing a company’s financial performance, investors and business owners often look beyond simple profit and loss figures. One of the most widely used financial metrics in corporate finance is EBITDA – a powerful tool that provides a clearer picture of a company’s operational efficiency and cash-generating ability.

What is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. In simple terms, it represents a company’s profitability from its core business operations, excluding the impact of financing decisions, tax strategies, and accounting methods for long-term assets.

Think of EBITDA as a way to measure how much cash a business generates from its day-to-day operations, stripping away factors that can vary significantly between companies or accounting periods. It’s like looking at a company’s raw earning power before considering how it’s financed or how it handles its assets.

Why is EBITDA Important?

EBITDA serves several crucial purposes in financial analysis:

For Investors and Analysts:

- Enables fair comparison between companies with different capital structures

- Removes the impact of different depreciation methods and tax situations

- Provides insight into operational efficiency and cash generation potential

- Helps evaluate acquisition targets and investment opportunities

For Business Owners:

- Offers a clear view of operational performance

- Assists in benchmarking against industry peers

- Supports lending and financing decisions

- Helps identify trends in core business profitability

For Lenders:

- Assesses a company’s ability to service debt

- Evaluates creditworthiness and lending risk

- Determines appropriate loan terms and covenants

How to Calculate EBITDA: Step-by-Step Guide

There are two primary methods to calculate EBITDA, both yielding the same result:

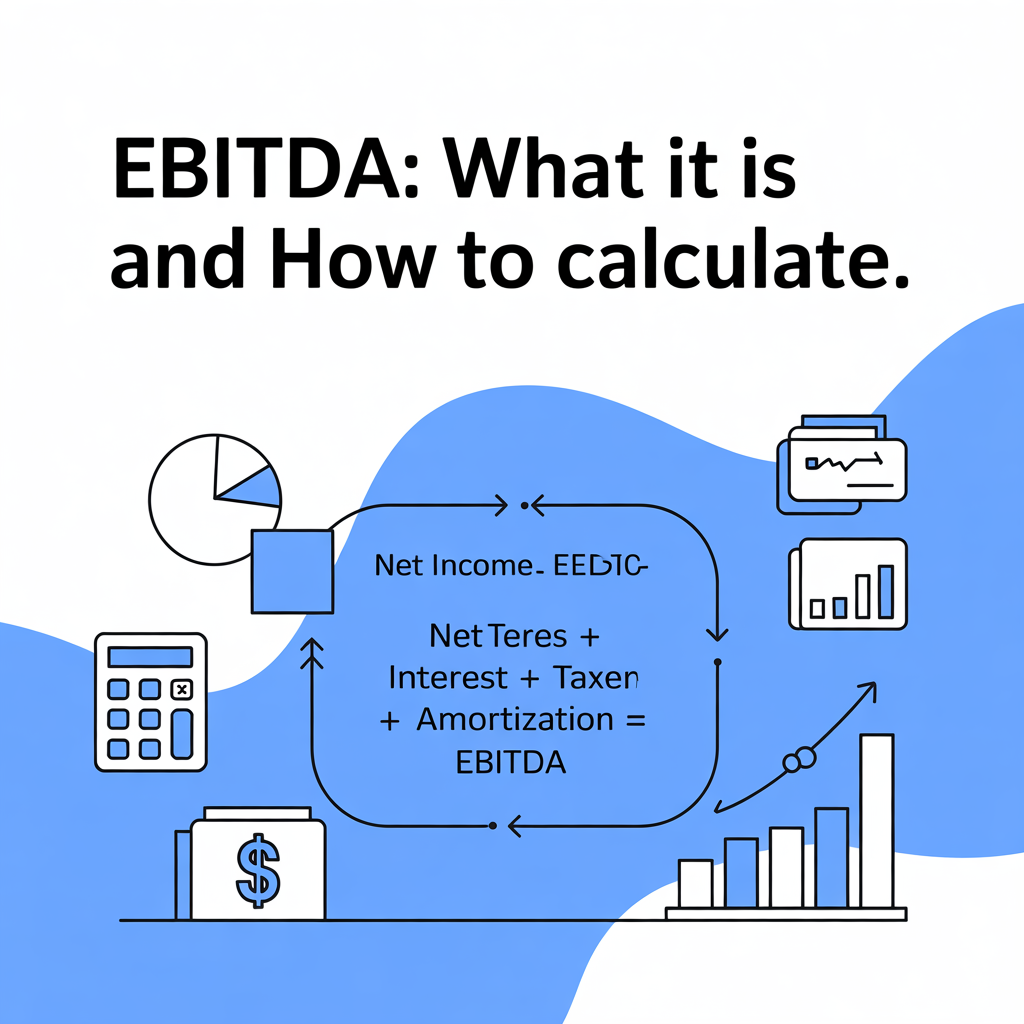

Method 1: Starting from Net Income

Formula: EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Step-by-step calculation:

- Start with Net Income (bottom line from income statement)

- Add back Interest Expense

- Add back Tax Expense

- Add back Depreciation Expense

- Add back Amortization Expense

Method 2: Starting from Operating Income

Formula: EBITDA = Operating Income + Depreciation + Amortization

Step-by-step calculation:

- Start with Operating Income (EBIT)

- Add back Depreciation Expense

- Add back Amortization Expense

Visual EBITDA Calculation Flow

[Net Income]

+

[Interest Expense]

+

[Tax Expense]

+

[Depreciation Expense]

+

[Amortization Expense]

=

[EBITDA]Suggested Image ALT Text: “EBITDA calculation flowchart showing Net Income plus Interest, Taxes, Depreciation, and Amortization equals EBITDA”

Real-World EBITDA Calculation Example

Let’s calculate EBITDA for a fictional manufacturing company, TechCorp Industries:

TechCorp Industries – Annual Financial Data:

- Net Income: $2,500,000

- Interest Expense: $300,000

- Tax Expense: $800,000

- Depreciation Expense: $450,000

- Amortization Expense: $150,000

EBITDA Calculation: EBITDA = $2,500,000 + $300,000 + $800,000 + $450,000 + $150,000 EBITDA = $4,200,000

This means TechCorp generates $4.2 million in earnings from its core operations before considering financing costs, taxes, and asset depreciation.

EBITDA vs Net Income vs Operating Income

Understanding the differences between these key financial metrics is essential:

Net Income (Bottom Line):

- Final profit after all expenses, including interest, taxes, depreciation, and amortization

- Shows ultimate profitability to shareholders

- Most affected by financing and tax strategies

Operating Income (EBIT):

- Earnings before interest and taxes

- Focuses on operational profitability

- Excludes financing decisions but includes depreciation and amortization

EBITDA:

- Purest measure of operational cash generation

- Excludes all non-cash expenses and financing/tax impacts

- Best for comparing operational efficiency across companies

Advantages of Using EBITDA

Operational Focus: EBITDA isolates core business performance from external factors like tax rates and financing structures.

Enhanced Comparability: Companies with different depreciation methods, debt levels, or tax situations can be compared more fairly.

Cash Flow Proxy: While not identical to cash flow, EBITDA provides a reasonable approximation of operational cash generation.

Industry Standardization: Widely accepted metric across industries, making benchmarking and valuation easier.

Debt Analysis: Lenders use EBITDA to assess debt service capability through ratios like Debt-to-EBITDA.

Limitations and Criticisms of EBITDA

Ignores Capital Requirements: EBITDA doesn’t account for the capital expenditures needed to maintain and grow the business.

Non-GAAP Metric: Not standardized under Generally Accepted Accounting Principles, leading to potential manipulation.

Excludes Real Costs: Interest and taxes are actual cash expenses that impact shareholder returns.

Working Capital Blind Spot: Doesn’t consider changes in working capital that affect cash flow.

Asset Intensity Ignorance: Companies with heavy asset requirements may appear similar to asset-light businesses.

When to Use EBITDA (and When Not To)

Appropriate Uses:

- Comparing companies within the same industry

- Evaluating acquisition targets

- Assessing operational improvements over time

- Initial screening for investment opportunities

Inappropriate Uses:

- Sole basis for investment decisions

- Comparing companies across vastly different industries

- Replacing comprehensive cash flow analysis

- Ignoring capital allocation efficiency

Frequently Asked Questions

Q: Is EBITDA the same as cash flow? A: No, EBITDA is not the same as cash flow. While it excludes non-cash expenses like depreciation, it doesn’t account for changes in working capital, capital expenditures, or actual cash movements.

Q: What’s a good EBITDA margin? A: EBITDA margins vary significantly by industry. Technology companies might achieve 30-40% margins, while retail businesses might see 8-15%. Compare companies within the same sector for meaningful analysis.

Q: Can EBITDA be negative? A: Yes, companies with operating losses will have negative EBITDA, indicating they’re losing money on core operations before considering financing and tax benefits.

Q: How often should EBITDA be calculated? A: Most companies calculate EBITDA quarterly and annually, aligning with standard financial reporting periods.

Q: Is higher EBITDA always better? A: Generally yes, but context matters. Consider EBITDA trends, industry comparisons, and whether growth requires significant capital investment that EBITDA doesn’t capture.

Conclusion

EBITDA remains one of the most valuable tools for understanding business performance and making informed financial decisions. While it shouldn’t be used in isolation, EBITDA provides crucial insights into operational efficiency and cash-generating potential that pure profit metrics might obscure.

Whether you’re an investor evaluating opportunities, a business owner tracking performance, or a financial professional conducting analysis, understanding EBITDA calculation and interpretation is essential for sound financial decision-making.

Ready to optimize your financial management? Consider consulting with qualified accounting professionals who can help you implement robust financial tracking systems and leverage metrics like EBITDA to drive better business decisions. Professional bookkeeping and accounting services can ensure your financial data is accurate, timely, and strategically useful for growing your business.