Introduction

Understanding the difference between debits and credits is fundamental to running a successful business. Whether you’re a startup entrepreneur or managing an established company, mastering these accounting basics will help you make informed financial decisions and maintain accurate books.

Many business owners find debit and credit confusing at first – and that’s completely normal. The accounting definition of these terms differs significantly from how we use them in everyday banking. In this comprehensive guide, we’ll break down everything you need to know about debits and credits, complete with real-world examples and practical applications for your business.

What Are Debits and Credits in Accounting?

The Foundation of Double-Entry Bookkeeping

Debits and credits form the backbone of double-entry bookkeeping, a system that has been used for over 500 years. In this system, every financial transaction affects at least two accounts, and the total debits must always equal the total credits.

Debit comes from the Latin word “debere,” meaning “to owe.” In accounting, a debit is an entry on the left side of an account that increases assets and expenses or decreases liabilities, equity, and revenue.

Credit derives from the Latin “credere,” meaning “to trust” or “to believe.” A credit is an entry on the right side of an account that increases liabilities, equity, and revenue or decreases assets and expenses.

The Accounting Equation

The fundamental accounting equation underlies all debit and credit transactions:

Assets = Liabilities + Owner’s Equity

This equation must always balance, which is why the double-entry system works so effectively for maintaining accurate financial records.

How Debits and Credits Work: The T-Account Method

Understanding T-Accounts

A T-account is a visual representation of how debits and credits affect different account types. Picture a large “T” – debits go on the left side, credits on the right side.

Account Name

________________

Debit | Credit

(Left) | (Right)

|

The Five Account Types and Their Normal Balances

Understanding which accounts increase with debits versus credits is crucial:

1. Assets (Normal Debit Balance)

- Cash, Accounts Receivable, Inventory, Equipment

- Increase with debits, decrease with credits

2. Liabilities (Normal Credit Balance)

- Accounts Payable, Loans Payable, Credit Cards

- Increase with credits, decrease with debits

3. Owner’s Equity (Normal Credit Balance)

- Owner’s Capital, Retained Earnings

- Increase with credits, decrease with debits

4. Revenue (Normal Credit Balance)

- Sales Revenue, Service Revenue, Interest Income

- Increase with credits, decrease with debits

5. Expenses (Normal Debit Balance)

- Rent Expense, Office Supplies, Utilities

- Increase with debits, decrease with credits

Real-World Debit and Credit Examples for Small Businesses

Example 1: Making a Cash Sale

Your bakery sells $500 worth of pastries for cash.

Transaction Analysis:

- Cash (Asset) increases by $500 → Debit Cash $500

- Sales Revenue increases by $500 → Credit Sales Revenue $500

Journal Entry:

Debit: Cash $500

Credit: Sales Revenue $500

Example 2: Purchasing Office Supplies on Credit

You buy $200 worth of office supplies and agree to pay later.

Transaction Analysis:

- Office Supplies (Asset) increases by $200 → Debit Office Supplies $200

- Accounts Payable (Liability) increases by $200 → Credit Accounts Payable $200

Journal Entry:

Debit: Office Supplies $200

Credit: Accounts Payable $200

Example 3: Paying Monthly Rent

You pay $2,000 for office rent.

Transaction Analysis:

- Rent Expense increases by $2,000 → Debit Rent Expense $2,000

- Cash (Asset) decreases by $2,000 → Credit Cash $2,000

Journal Entry:

Debit: Rent Expense $2,000

Credit: Cash $2,000

Example 4: Receiving Payment from Customer

A customer pays $1,500 they owed you.

Transaction Analysis:

- Cash (Asset) increases by $1,500 → Debit Cash $1,500

- Accounts Receivable (Asset) decreases by $1,500 → Credit Accounts Receivable $1,500

Journal Entry:

Debit: Cash $1,500

Credit: Accounts Receivable $1,500

Example 5: Taking Out a Business Loan

Your business receives a $10,000 bank loan.

Transaction Analysis:

- Cash (Asset) increases by $10,000 → Debit Cash $10,000

- Notes Payable (Liability) increases by $10,000 → Credit Notes Payable $10,000

Journal Entry:

Debit: Cash $10,000

Credit: Notes Payable $10,000

Common Debit and Credit Mistakes to Avoid

Mistake 1: Confusing Bank Statement Terms

Your bank statement shows deposits as credits and withdrawals as debits from the bank’s perspective. This is opposite to how you record these transactions in your business books.

Mistake 2: Forgetting the Accounting Equation

Always ensure your debits equal your credits for each transaction. If they don’t balance, you’ve made an error.

Mistake 3: Mixing Up Normal Balances

Remember that assets and expenses have normal debit balances, while liabilities, equity, and revenue have normal credit balances.

Mistake 4: Recording Only One Side of a Transaction

Every transaction affects at least two accounts. Never record just a debit or just a credit without the corresponding entry.

Advanced Debit and Credit Concepts

Compound Journal Entries

Some transactions affect more than two accounts. For example, if you purchase equipment partly with cash and partly with a loan:

Transaction: Buy $5,000 equipment with $2,000 cash and $3,000 loan

Journal Entry:

Debit: Equipment $5,000

Credit: Cash $2,000

Credit: Notes Payable $3,000

Adjusting Entries

At the end of accounting periods, you’ll need to make adjusting entries to ensure accurate financial reporting. These follow the same debit and credit rules but often involve accruals and deferrals.

Closing Entries

Revenue and expense accounts are temporary and must be closed at year-end. This process transfers their balances to retained earnings using debits and credits.

How Technology Simplifies Debit and Credit Tracking

Modern Accounting Software

Today’s accounting software automatically handles much of the debit and credit complexity. However, understanding these fundamentals helps you:

- Review transactions for accuracy

- Understand financial reports

- Communicate effectively with your bookkeeper

- Make better business decisions

Integration with Banking

Bank feeds automatically import transactions, but you still need to categorize them correctly using debit and credit principles.

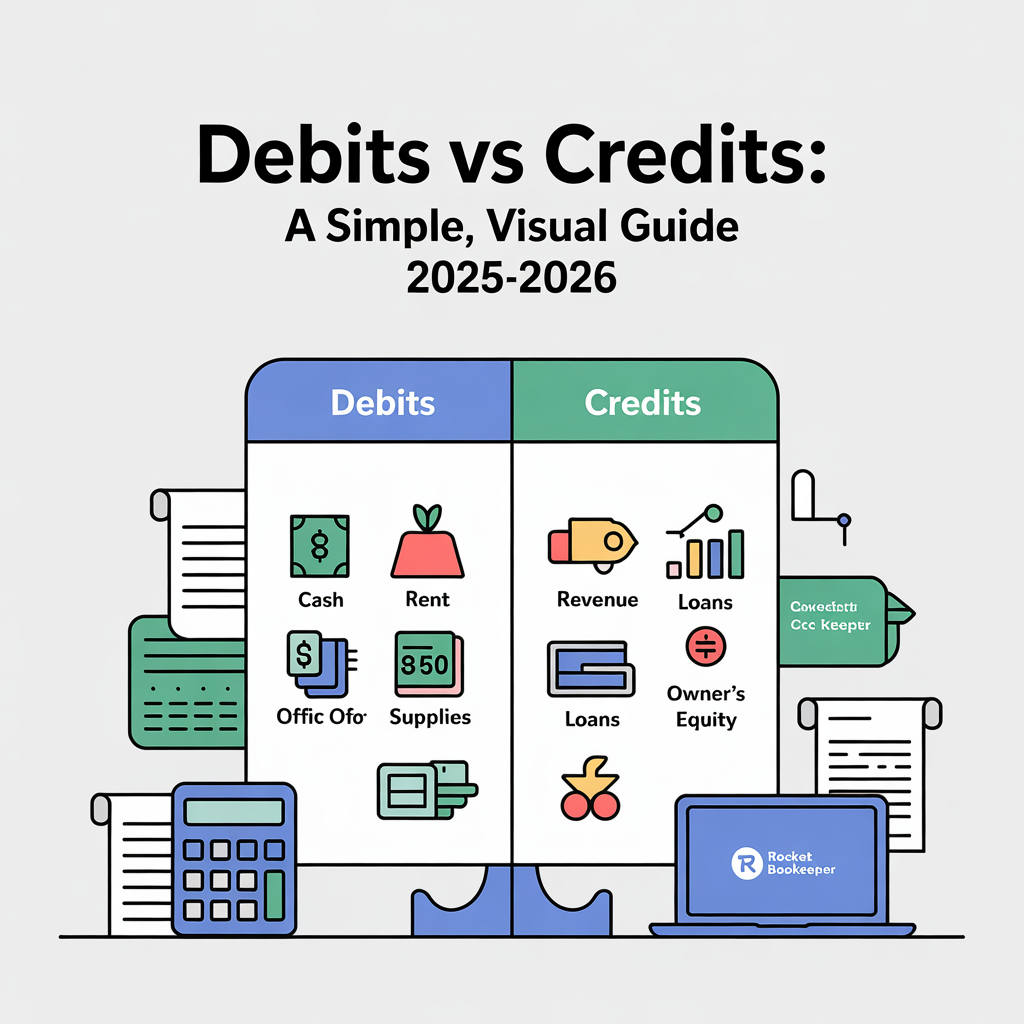

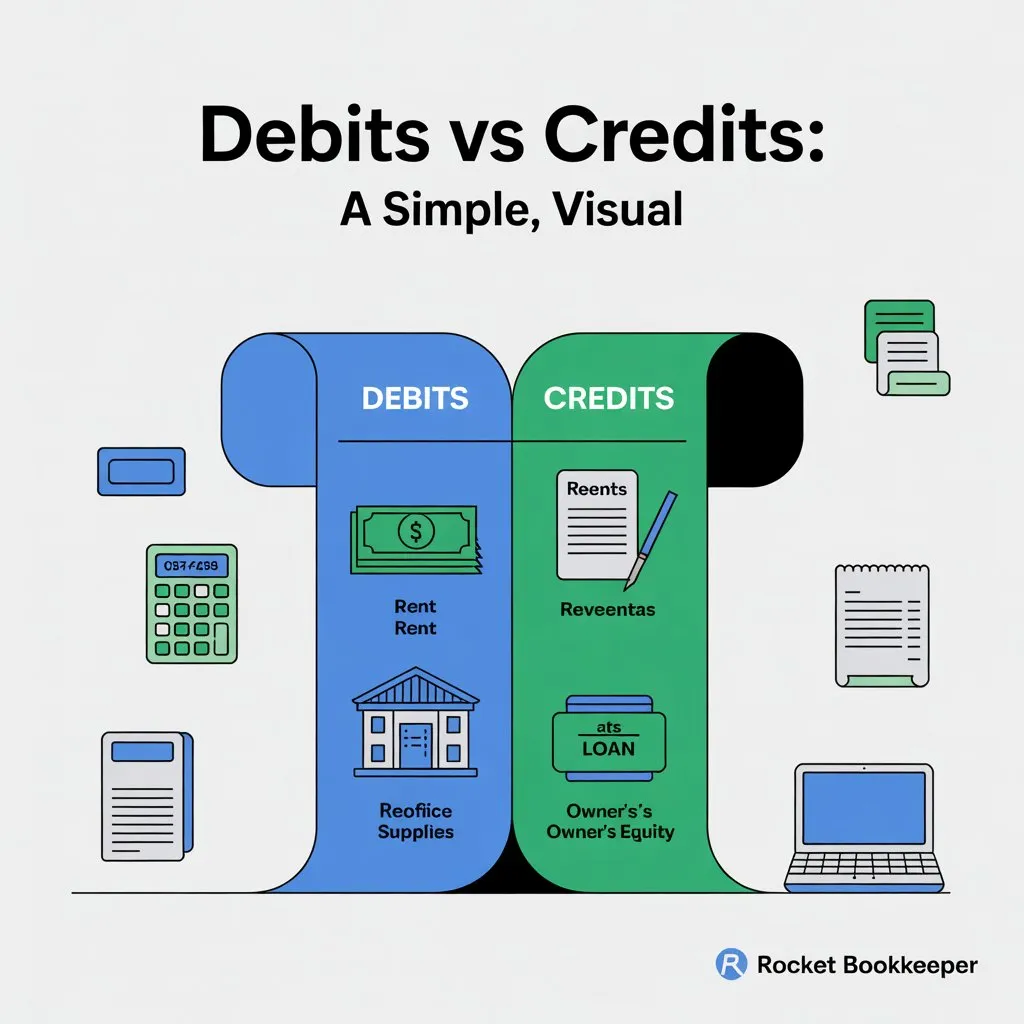

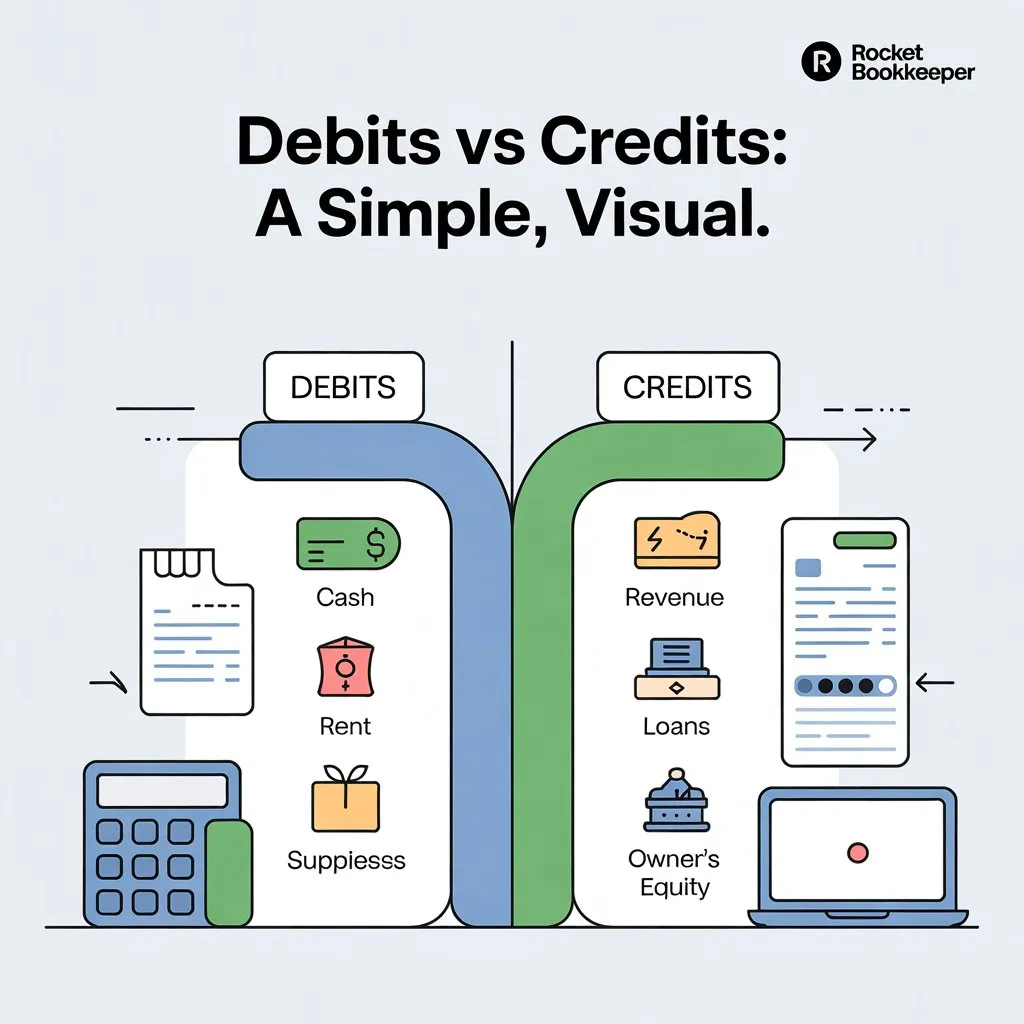

Visual Learning: Debit vs Credit Comparison

Quick Reference Table

| Account Type | Increases With | Decreases With | Normal Balance |

| Assets | Debit | Credit | Debit |

| Liabilities | Credit | Debit | Credit |

| Owner’s Equity | Credit | Debit | Credit |

| Revenue | Credit | Debit | Credit |

| Expenses | Debit | Credit | Debit |

Memory Aids

DEALER – Debits increase:

- Dividends

- Expenses

- Assets

- Losses

- Equity reductions

- Revenue decreases

Industry-Specific Debit and Credit Applications

Retail Business

Inventory management requires careful tracking of debits and credits as products are purchased, sold, and returned.

Service Business

Labor costs, overhead allocation, and client billing all involve specific debit and credit patterns.

Manufacturing

Work-in-progress inventory, raw materials, and finished goods create complex debit and credit relationships.

The Impact of Debits and Credits on Financial Statements

Balance Sheet Effects

Assets appear on the left side of the balance sheet with normal debit balances. Liabilities and equity appear on the right with normal credit balances.

Income Statement Effects

Revenue accounts with credit balances appear as positive income. Expense accounts with debit balances appear as costs that reduce net income.

Cash Flow Statement

Understanding debits and credits helps you analyze how different transactions affect cash flow from operations, investing, and financing activities.

Best Practices for Managing Debits and Credits

Daily Transaction Recording

Record transactions promptly to maintain accuracy and avoid forgetting important details.

Regular Reconciliation

Monthly bank reconciliations ensure your cash account debits and credits match your bank statements.

Chart of Accounts Organization

Maintain a well-organized chart of accounts to ensure consistent debit and credit posting.

Documentation Standards

Keep supporting documentation for all debit and credit entries to support your records during audits or reviews.

Frequently Asked Questions

What’s the difference between debit and credit in banking vs accounting?

In banking, a debit removes money from your account (like a debit card purchase), while a credit adds money (like a deposit). In accounting, debits and credits follow the rules of double-entry bookkeeping – debits increase assets and expenses, while credits increase liabilities, equity, and revenue.

Why do debits always equal credits?

The double-entry bookkeeping system requires debits to equal credits to maintain the fundamental accounting equation (Assets = Liabilities + Owner’s Equity). This ensures mathematical accuracy and helps identify errors quickly.

How do I know whether to debit or credit an account?

First, identify the account type (asset, liability, equity, revenue, or expense). Then determine if the transaction increases or decreases that account. Use the normal balance rules: assets and expenses increase with debits, while liabilities, equity, and revenue increase with credits.

What happens if my debits don’t equal my credits?

If debits don’t equal credits, you have an error in your books. This could be from entering wrong amounts, posting to incorrect accounts, or missing part of a transaction. You’ll need to review and correct the entries to restore balance.

Can a transaction have multiple debits or credits?

Yes, transactions can affect multiple accounts. The key rule is that total debits must equal total credits for each transaction, regardless of how many accounts are involved.

How often should I review my debit and credit entries?

Review entries daily when recording transactions, reconcile monthly with bank statements, and perform quarterly reviews of all accounts to ensure accuracy and catch any errors early.

Why Professional Bookkeeping Matters

While understanding debits and credits is essential, managing them correctly requires expertise, time, and attention to detail. Small business owners often struggle with:

- Complex transaction categorization

- Month-end adjusting entries

- Financial statement preparation

- Tax compliance requirements

- Cash flow management

Professional bookkeepers ensure your debits and credits are recorded accurately, your books are always balanced, and your financial reports provide reliable information for business decisions.

Take Control of Your Business Finances Today

Understanding debits and credits is just the beginning of effective financial management. At Rocket Bookkeeper, we specialize in providing comprehensive bookkeeping and finance services exclusively for US-based businesses.

Our expert team handles all aspects of your financial records – from daily transaction recording to complex financial reporting – so you can focus on growing your business. We ensure your books are accurate, compliant, and provide the insights you need to make informed decisions.

Ready to streamline your bookkeeping and gain financial clarity?

Contact Rocket Bookkeeper today for a free consultation. Let our experienced professionals handle your debits, credits, and everything in between while you focus on what you do best – running your business.

Don’t let bookkeeping complexities hold your business back. Partner with Rocket Bookkeeper and experience the peace of mind that comes with professional financial management.