Key Takeaways

- Enhanced Security: Cloud bookkeeping offers bank-level security with offsite data storage, safeguarding against cyber threats and natural disasters.

- Time Savings: Automated transaction syncing and bank integrations reduce manual data entry errors by up to 80%.

- Cost Efficiency: Flexible, pay-as-you-grow pricing eliminates upfront hardware costs and reduces IT expenses.

- Client Transparency: Real-time access to financial data builds trust and improves client satisfaction.

- Automatic Backups: Redundant backups ensure your data is always safe and retrievable.

What Is Cloud Bookkeeping?

Cloud bookkeeping is the modern way of managing financial records using cloud-based software instead of traditional desktop applications. It leverages secure, hosted environments to store data, run accounting tools, and enable real-time collaboration between bookkeepers, accountants, and clients.

In simpler terms, it’s your familiar bookkeeping process—supercharged with the power, security, and accessibility of cloud technology.

For accounting firms in 2025, cloud bookkeeping isn’t just a convenience—it’s the new standard. With rising cybersecurity demands from the IRS and growing client expectations for instant financial insights, traditional bookkeeping methods are quickly becoming outdated.

Why Cloud Bookkeeping Is Essential for Modern Firms

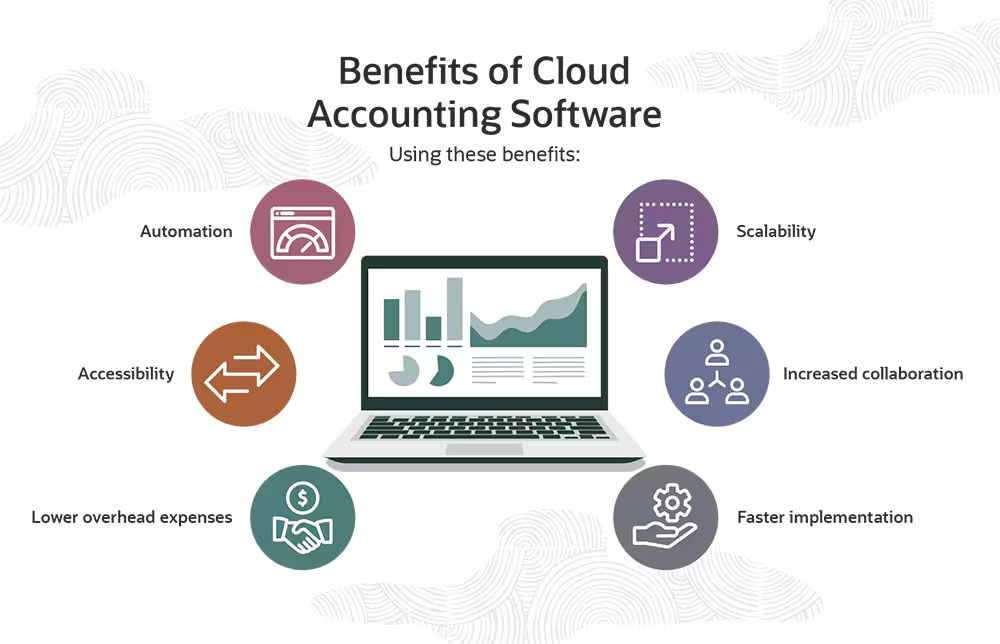

Switching to cloud bookkeeping isn’t just a tech upgrade—it’s a game-changer for how firms operate, serve clients, and stay compliant. Here’s why forward-thinking firms are making the leap:

1. Enhanced Security and Compliance

Cloud bookkeeping provides the same level of security as major banks, protecting sensitive client data from cyber threats and reducing liability risks. Built-in features like automatic updates and malware protection ensure compliance with IRS Security Six requirements, so you can focus on serving clients instead of worrying about regulations.

Additionally, cloud platforms store data in secure, professionally managed data centers. This means your files are safe from physical disasters like floods, fires, or theft, ensuring uninterrupted service for your clients.

2. Significant Time Savings

Manual data entry? A thing of the past. Cloud bookkeeping automates transaction syncing, categorization, and reconciliation, saving your team hours of tedious work. This efficiency allows you to focus on higher-value services like financial analysis and strategic advice.

Month-end close becomes a breeze, with fewer errors and faster processing. Your team can leave the office on time, and clients receive their reports promptly—no more delays or late nights.

Everything integrates seamlessly in the cloud. Bank accounts, credit cards, payroll systems, and payment processors all connect automatically, eliminating the need for manual imports or reconciliations. It’s bookkeeping that just works.

3. Automatic Backup and Disaster Recovery

Losing client data is every firm’s worst nightmare. With cloud bookkeeping, that fear disappears. Data is automatically backed up multiple times a day across geographically distributed locations. Even if one data center experiences issues, your information remains safe and accessible.

In emergencies—whether natural disasters or accidental deletions—your firm keeps running. Staff can work remotely, clients can access their records, and business continues without interruption. Recovery is quick and painless, giving you peace of mind and protecting your reputation.

4. Cost-Effective Scalability

Cloud bookkeeping replaces unpredictable IT expenses with simple, predictable monthly pricing. There’s no need for costly servers or software licenses—just pay for what you use. Scaling up for new clients or seasonal work is as easy as adding users, while scaling down helps manage costs during slower periods.

Hidden savings add up too. No server rooms mean lower electricity bills, reduced office space needs, and fewer IT support costs. These savings can be reinvested into growing your practice.

5. Improved Client Relationships

Today’s clients expect instant access to their financial data, and cloud bookkeeping delivers. Clients can log in anytime to view up-to-date financials, reducing the need for time-consuming “quick question” calls.

Collaboration becomes effortless. Clients can upload receipts directly, you can add notes, and everyone stays on the same page without endless email chains. This transparency builds trust and strengthens relationships.

Most importantly, automation frees you to focus on advisory services. From cash flow analysis to strategic tax planning, you can offer the high-value insights clients need—justifying premium fees and solidifying your role as a trusted advisor.

Cloud vs. Traditional Bookkeeping: A Side-by-Side Comparison

| Aspect | Cloud Bookkeeping | Traditional Bookkeeping |

|---|---|---|

| Security | Bank-level encryption, automatic updates, offsite storage | Varies by firm, manual updates, local storage vulnerable to theft/damage |

| Accessibility | Access from anywhere, anytime, on any device | Office-bound, limited to specific computers |

| Collaboration | Real-time multi-user access with role-based permissions | File sharing via email, version control challenges |

| Cost Structure | Predictable monthly subscriptions, no hardware costs | Large upfront software costs, ongoing IT expenses |

| Backup & Recovery | Automatic, continuous, geographically distributed | Manual processes, physical media, single location |

| Compliance | Built-in compliance features, automatic updates | Manual compliance tracking, periodic updates |

| Scalability | Instant scaling up or down as needed | Hardware/software limitations, upgrade costs |

The Future Is Cloud-Enabled

Cloud bookkeeping isn’t just a technological shift—it’s a strategic advantage for firms looking to enhance security, efficiency, and client satisfaction. With features like bank-level encryption, automatic backups, and cost-effective scalability, the question isn’t whether to adopt cloud bookkeeping—it’s how soon you can make the transition.

At Rocket Bookkeeper, we’re here to help you navigate this transformation. Ready to take your bookkeeping to the next level? Let’s get started today.