How AR & AP Assistance Improves Cash Flow

Optimizing your cash flow is crucial for business survival and growth. For many businesses, the key to unlocking better cash flow lies in the effective management of Accounts Receivable (AR) and Accounts Payable (AP). Professional bookkeeping assistance, like that offered by Rocket Bookkeeper, can transform these areas from administrative burdens into strategic assets.

Managing DSO through AR Assistance

Days Sales Outstanding (DSO) is a critical metric that measures the average number of days it takes for your company to collect payment after a sale. A lower DSO means faster cash collection.

- AR assistance helps in reducing DSO by:

- Implementing clear credit policies.

- Timely and accurate invoicing.

- Proactive follow-up on outstanding invoices.

- Systematic collection efforts tailored to client history.

By professionally managing your AR, you shorten the cash conversion cycle, making funds available faster for operations or investment.

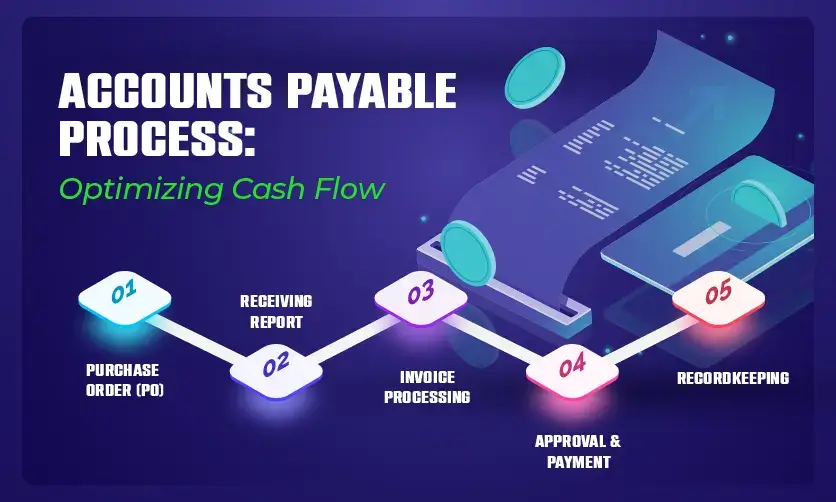

Stretching Payables Responsibly

While speeding up receivables is paramount, managing payables strategically is equally important. Stretching payables responsibly means utilizing the full payment terms offered by your vendors without incurring late fees or damaging vendor relationships.

- AP assistance ensures:

- Accurate tracking of due dates to pay on the last possible day.

- Negotiation of favorable payment terms when possible.

- Avoiding costly early payment discounts unless the return on capital outweighs the discount.

This strategy keeps cash in your business longer, improving working capital.

Balancing Receivables and Payables

The ultimate goal of cash flow optimization is to effectively balance receivables and payables. Ideally, you want to collect cash from customers (AR) before you have to pay your suppliers (AP).

- Rocket Bookkeeper helps achieve this balance by providing:

- Real-time visibility into both AR aging and AP schedules.

- Forecasting of cash inflows and outflows.

- Strategic scheduling of payments based on expected collections.

This synchronization minimizes the need for short-term borrowing and ensures liquidity.

AR Factoring vs. Internal AR Assistance

When cash is tight, some businesses consider AR Factoring, which involves selling your invoices to a third party (the factor) at a discount for immediate cash. While it provides quick cash, it’s expensive.

Internal AR Assistance (professional bookkeeping) is often a more sustainable and cost-effective long-term solution. It focuses on improving your internal collection process, keeping your profit margins intact and maintaining the client relationship.

Vendor Payment Timing Strategies

Effective AP management involves sophisticated vendor payment timing strategies. These can include:

- Utilizing prompt payment discounts only when the effective interest rate of the discount is higher than your current borrowing rate.

- Standardizing payment cycles (e.g., paying all vendors on the 15th and 30th of the month) for better internal control and predictability.

- Prioritizing critical vendors to ensure supply chain stability.

When to Outsource AR/AP

The decision when to outsource AR/AP usually hinges on cost-benefit analysis and capacity. You should consider outsourcing when:

- Your DSO is increasing.

- Your internal staff is overwhelmed or lacks specialized expertise.

- Late payments are damaging vendor relationships or resulting in fees.

- You want to free up internal resources to focus on core business functions.

For growing businesses in major financial hubs like San Francisco, New York, Chicago, and Los Angeles, outsourcing to a specialist like Rocket Bookkeeper ensures high-level, focused expertise.

Technology in AR/AP Assistance

Modern technology in AR/AP assistance is a game-changer. Rocket Bookkeeper utilizes cloud-based accounting software and automation tools to:

- Automate invoice generation and bill entry.

- Set up automated payment reminders.

- Integrate banking and payment systems.

- Provide real-time reporting and dashboards.

This automation reduces human error, speeds up processes, and provides superior data for decision-making.

Cost Savings from AR/AP Support

The direct and indirect cost savings from AR/AP support are significant:

| Area of Saving | Description |

| Reduced Fees | Lowering late payment fees and collection costs. |

| Staff Efficiency | Freeing up internal staff from manual data entry. |

| Opportunity Cost | Using collected cash for investment rather than short-term debt. |

| Negotiating Power | Better leverage with vendors through timely, managed payments. |

Case Studies: AR/AP Assistance

A small-scale tech startup in New York leveraged our AR assistance to reduce its DSO from 60 days to 35 days in six months, freeing up over $50,000 in working capital. Similarly, a wholesale distributor in San Francisco used our AP management to standardize its payment schedule, virtually eliminating all late fees and improving its vendor relationships. These examples highlight the tangible benefits of strategic AR/AP management across various industries and locations.