Finding the right virtual bookkeeper for your business can transform your financial management and free up valuable time for growing your company. With the rise of remote work and cloud-based accounting solutions, virtual bookkeeping services have become increasingly popular among small businesses and startups across the USA.

What Are Virtual Bookkeeping Services?

Virtual bookkeeping services involve professional bookkeepers working remotely to manage your business’s financial records through cloud-based accounting software. These online bookkeeping services provide the same level of expertise as traditional in-house bookkeepers but offer greater flexibility and often more cost-effective solutions.

Virtual bookkeepers handle essential tasks including:

- Recording daily transactions

- Account reconciliation

- Financial statement preparation

- Payroll processing

- Tax preparation support

- Cash flow management

Why Choose Virtual Bookkeeping Services for Your Business?

Cost-Effective Solution

Virtual bookkeeping companies typically charge 30-50% less than hiring full-time, in-house staff. This makes professional bookkeeping services accessible to small businesses and startups that might otherwise struggle with accounting costs.

Access to Expertise

When you work with established bookkeeping firms, you gain access to certified professionals with diverse industry experience. Many virtual accounting services employ CPAs and certified bookkeepers who stay current with tax laws and accounting standards.

Scalability and Flexibility

Online bookkeeping services can easily scale with your business growth. Whether you need basic transaction recording or comprehensive accounting services for small business operations, virtual providers can adjust their services accordingly.

Key Factors to Consider When Choosing Virtual Bookkeepers

1. Professional Certifications and Qualifications

Look for bookkeepers with credentials from reputable organizations such as:

- National Association of Certified Public Bookkeepers (NACPB)

- American Institute of Professional Bookkeepers (AIPB)

- QuickBooks ProAdvisor certification

- Certified Public Accountant (CPA) credentials

2. Industry Experience

Choose bookkeeping services that specialize in your industry. Different sectors have unique accounting requirements, and experienced virtual bookkeepers will understand your specific needs and compliance requirements.

3. Technology and Software Compatibility

Ensure your chosen virtual bookkeeping services use accounting software compatible with your business systems. Popular platforms include:

- QuickBooks Online

- Xero

- Wave Accounting

- FreshBooks

4. Security and Data Protection

Virtual accounting services must implement robust security measures to protect your financial data. Look for providers that offer:

- Bank-level encryption

- Secure data backup systems

- Multi-factor authentication

- Regular security audits

5. Communication and Responsiveness

Effective communication is crucial for successful virtual bookkeeping relationships. Your bookkeeper should provide:

- Regular financial reports

- Prompt responses to inquiries

- Clear explanations of financial matters

- Scheduled check-ins and reviews

Types of Virtual Bookkeeping Services Available

Individual Virtual Bookkeepers

Small business accountants working independently often provide personalized service and can develop close working relationships with clients. They typically offer competitive rates and flexible arrangements.

Bookkeeping Firms and Companies

Larger virtual bookkeeping companies provide team-based services with backup support and standardized processes. These firms often offer comprehensive packages including tax preparation services and payroll management.

Outsourced Bookkeeping Services

Full-service providers handle all aspects of financial management, from basic bookkeeping to complex accounting services for small business operations. These services are ideal for companies seeking comprehensive financial support.

Virtual Bookkeeping vs Traditional Bookkeeping: A Complete Comparison

Understanding the differences between online and traditional bookkeeping helps you make an informed decision for your business.

Cost Comparison

Traditional Bookkeeping Costs:

- Full-time salary: $35,000-$50,000 annually

- Benefits and payroll taxes: Additional 25-30%

- Office space and equipment

- Training and development expenses

Online Bookkeeping Costs: Virtual bookkeeping services typically cost $200-$2,000 monthly, representing significant savings for most businesses.

Efficiency and Speed

Traditional Method Limitations:

- Limited to business hours

- Single-person dependency

- Physical document management

- Manual backup processes

Online Method Advantages:

- 24/7 access to financial data

- Team-based support from bookkeeping firms

- Automated backup and security

- Real-time financial reporting

Complete Pricing Guide for Virtual Bookkeeping Services

Understanding bookkeeping service costs helps you budget effectively and choose the right provider for your business needs.

Basic Pricing Tiers

Startup Package ($200-$500/month) Ideal for new businesses with minimal transactions:

- Monthly transaction recording (up to 50 transactions)

- Basic financial statements

- Bank reconciliation

- Email support

Growth Package ($500-$1,200/month) Perfect for small business bookkeeping needs:

- Unlimited transaction recording

- Detailed financial reporting

- Payroll processing (up to 10 employees)

- Phone and email support

- Monthly financial review calls

Enterprise Package ($1,200-$3,000/month) Comprehensive solution for established businesses:

- Full-service bookkeeping

- Advanced financial statements

- Tax preparation support

- Dedicated account manager

- Weekly reporting and consultations

Factors Affecting Pricing

Transaction Volume Most virtual bookkeeping companies price based on monthly transaction volume:

- 0-50 transactions: Basic tier

- 51-200 transactions: Mid-tier

- 200+ transactions: Enterprise tier

Industry Complexity Specialized industries may require premium pricing:

- Construction and contracting

- Healthcare and medical practices

- E-commerce and retail

- Professional services

Top Virtual Bookkeeping Companies in USA

Choosing from the numerous virtual bookkeeping services available can be overwhelming. Here are key evaluation criteria and top providers.

Evaluation Criteria

We assess bookkeeping firms based on:

- Professional certifications and expertise

- Technology platform quality

- Customer service and support

- Pricing transparency

- Industry specializations

- Security measures

Leading Providers

Rocket Bookkeeper Industry-Leading Virtual Bookkeeping Solutions

Rocket Bookkeeper stands out as a premier provider of comprehensive virtual accounting services. Our team of certified professionals delivers personalized service with cutting-edge technology integration.

Key Features:

- Certified bookkeepers and CPAs on staff

- Advanced cloud-based accounting software integration

- Specialized small business bookkeeping packages

- Comprehensive tax preparation support

- Dedicated account management

- Bank-level security protocols

Service Offerings:

- Full-service bookkeeping and accounting

- Payroll management services

- Financial statement preparation

- Tax planning and preparation

- Cash flow management

- Business consultation services

Specialized Service Providers

Industry-Specific Solutions Some virtual bookkeeping companies specialize in particular sectors:

- Healthcare Bookkeeping: HIPAA-compliant solutions

- Construction Accounting: Job costing and project management

- E-commerce Specialists: Multi-platform integration and inventory tracking

- Professional Services: Time tracking and project profitability analysis

Small Business Bookkeeping: Complete Guide

Small business owners face unique financial management challenges. Virtual bookkeeping services can help small businesses maintain accurate records, ensure compliance, and make informed financial decisions.

Small Business Bookkeeping Essentials

Daily Transaction Management Proper bookkeeping starts with accurate daily transaction recording:

- Sales and revenue tracking

- Expense categorization

- Bank and credit card reconciliation

- Invoice and payment management

Monthly Financial Tasks Professional bookkeeping services handle crucial monthly activities:

- Financial statement preparation

- Account reconciliation

- Sales tax reporting

- Payroll processing and reporting

Common Small Business Challenges

Limited Resources Small businesses often struggle with:

- Budget constraints for hiring full-time staff

- Lack of accounting expertise

- Time management issues

- Seasonal cash flow variations

Compliance Requirements Regulatory challenges include:

- Tax preparation and filing

- Sales tax compliance

- Payroll tax obligations

- Financial reporting requirements

Benefits of Virtual Bookkeeping for Small Businesses

Cost-Effective Solutions Virtual bookkeeping companies offer significant advantages:

- Lower costs than hiring full-time employees

- No office space or equipment requirements

- Access to certified professionals

- Scalable service packages

Technology Advantages Modern virtual accounting services provide:

- Cloud-based accounting software integration

- Real-time financial data access

- Automated backup and security

- Mobile app connectivity

Essential Bookkeeping Services Your Business Needs

Core Bookkeeping Functions

- Transaction recording and categorization

- Bank and credit card reconciliation

- Accounts payable and receivable management

- Financial statement preparation

- Budget creation and monitoring

Additional Services

- Payroll management and tax filing

- Sales tax preparation and filing

- Year-end tax preparation

- Financial analysis and reporting

- Cash flow forecasting

Specialized Services

- Industry-specific accounting requirements

- Multi-location bookkeeping

- International transaction handling

- Audit preparation and support

Questions to Ask Potential Virtual Bookkeepers

When evaluating online bookkeeping services, consider asking:

1. What certifications and qualifications do you hold?

What to Look For:

- Certified Public Bookkeeper (CPB) certification

- QuickBooks ProAdvisor certification

- American Institute of Professional Bookkeepers (AIPB) certification

- National Association of Certified Public Bookkeepers (NACPB) membership

- CPA credentials for advanced services

- Ongoing education and training records

Red Flags: Bookkeepers without any professional certifications or those who cannot provide proof of their credentials.

2. Do you have experience in my industry?

What to Look For:

- Specific experience with businesses similar to yours

- Understanding of industry-specific regulations and requirements

- Knowledge of specialized accounting practices for your sector

- Client testimonials from your industry

- Familiarity with industry-standard software and processes

Examples by Industry:

- Construction: Job costing, progress billing, equipment depreciation

- E-commerce: Multi-channel sales tracking, inventory management

- Healthcare: HIPAA compliance, insurance billing procedures

- Professional Services: Time tracking, project profitability analysis

3. Which accounting software do you recommend and support?

What to Look For:

- Proficiency in popular platforms like QuickBooks Online, Xero, or Wave

- Ability to work with your existing software

- Recommendations based on your business size and needs

- Training and support for software transitions

- Integration capabilities with other business tools

Software Recommendations:

- Small Businesses: QuickBooks Online, Wave Accounting

- Growing Companies: Xero, QuickBooks Online Plus

- Enterprise Level: Advanced QuickBooks versions, NetSuite

4. What security measures protect my financial data?

What to Look For:

- Bank-level encryption (256-bit SSL)

- Multi-factor authentication requirements

- Regular security audits and updates

- Secure cloud storage with automated backups

- Employee background checks and confidentiality agreements

- Professional liability insurance coverage

Security Standards:

- SOC 2 compliance

- GDPR compliance for international operations

- Regular penetration testing

- Incident response procedures

5. How do you handle communication and reporting?

What to Look For:

- Clear communication channels (email, phone, video calls)

- Regular reporting schedules (weekly, monthly, quarterly)

- Dedicated account manager or point of contact

- Response time guarantees

- Scheduled review meetings

- Access to real-time financial dashboards

Communication Standards:

- 24-hour response time for emails

- Monthly financial statement delivery

- Quarterly business review calls

- Emergency contact procedures

6. What is your pricing structure?

What to Look For:

- Transparent, flat-rate pricing models

- Clear breakdown of services included

- No hidden fees or surprise charges

- Scalable pricing that grows with your business

- Payment terms and schedule options

- Contract flexibility and cancellation policies

Pricing Models:

- Transaction-based: $0.50-$2.00 per transaction

- Monthly packages: $200-$2,000 based on complexity

- Hourly rates: $30-$100 per hour for specialized work

- Annual contracts: Often include discounts of 10-20%

7. Can you provide references from similar businesses?

What to Look For:

- At least 3-5 client references from your industry

- Permission to contact references directly

- Case studies or success stories

- Online reviews and testimonials

- Better Business Bureau ratings

- Professional association memberships

Questions for References:

- Quality and accuracy of work

- Timeliness of deliverables

- Communication effectiveness

- Problem-solving capabilities

- Overall satisfaction rating

8. Do you offer additional services like tax preparation?

What to Look For:

- Comprehensive service offerings beyond basic bookkeeping

- Qualified tax preparers on staff

- Integration between bookkeeping and tax services

- Year-round tax planning support

- Multi-state tax filing capabilities

- IRS representation services

Additional Services Available:

- Tax Services: Individual and business tax preparation, quarterly filings

- Payroll Management: Employee pay processing, tax withholding

- Financial Planning: Cash flow forecasting, budget development

- Business Consulting: Growth planning, financial analysis

- Audit Support: Preparation and representation services

9. How do you handle data backup and recovery?

What to Look For:

- Automated daily backups to secure cloud servers

- Multiple backup locations for redundancy

- Regular backup testing and verification

- Disaster recovery procedures and timelines

- Data retention policies and compliance

- Emergency access procedures

Backup Standards:

- Real-time or daily automated backups

- 30-60 day data retention minimum

- Geographic backup distribution

- 99.9% uptime guarantees

- Recovery time objectives under 24 hours

10. What is your process for onboarding new clients?

What to Look For:

- Structured, step-by-step onboarding process

- Clear timeline for implementation

- Data migration assistance and support

- Training sessions for your team

- Initial account setup and configuration

- Ongoing support during transition period

Typical Onboarding Process:

- Initial Consultation: Needs assessment and service planning

- Contract Signing: Service agreement and pricing confirmation

- Data Collection: Historical records and system access setup

- Account Setup: Software configuration and chart of accounts

- Data Migration: Transfer of existing financial information

- Training Sessions: Staff training on new procedures

- Go-Live Support: Intensive support during first month

- Regular Operations: Transition to standard service delivery

Timeline Expectations:

- Simple setups: 1-2 weeks

- Standard businesses: 2-4 weeks

- Complex operations: 4-8 weeks

- Full integration: 30-90 days depending on business size

Red Flags to Avoid When Choosing Virtual Bookkeepers

Be cautious of virtual accounting services that:

- Lack proper certifications or credentials

- Offer prices that seem too good to be true

- Have poor communication or delayed responses

- Cannot provide client references

- Use outdated or unsecure technology

- Have no established business presence online

- Promise unrealistic turnaround times

- Don’t explain their processes clearly

Technology and Software Considerations

Popular Accounting Software Platforms

QuickBooks Online

- Most widely used business accounting software

- Extensive integration capabilities

- Mobile app availability

- Strong reporting features

Xero

- Cloud-based accounting solution

- User-friendly interface

- Excellent third-party integrations

- Real-time collaboration features

Wave Accounting

- Free accounting software for small businesses

- Basic invoicing and payment processing

- Limited advanced features

- Good for startups and micro-businesses

Integration Requirements

Ensure your virtual bookkeeper can work with:

- Your current accounting software

- Banking and credit card systems

- Payment processing platforms

- Inventory management systems

- Payroll software

Security and Data Protection in Virtual Bookkeeping

Essential Security Features

- SSL encryption for data transmission

- Secure cloud storage with regular backups

- Multi-factor authentication

- Regular security updates and patches

- Compliance with industry standards

Data Protection Measures

- Limited access controls

- Regular security audits

- Employee background checks

- Confidentiality agreements

- Insurance coverage for data breaches

Tax Preparation and Compliance Support

Year-Round Tax Planning

Virtual bookkeepers provide ongoing tax support including:

- Quarterly estimated tax calculations

- Tax deduction optimization

- Compliance monitoring

- Document organization for tax season

Annual Tax Services

- Individual and business tax return preparation

- Multi-state tax filing

- Tax planning strategies

- IRS correspondence handling

- Audit support and representation

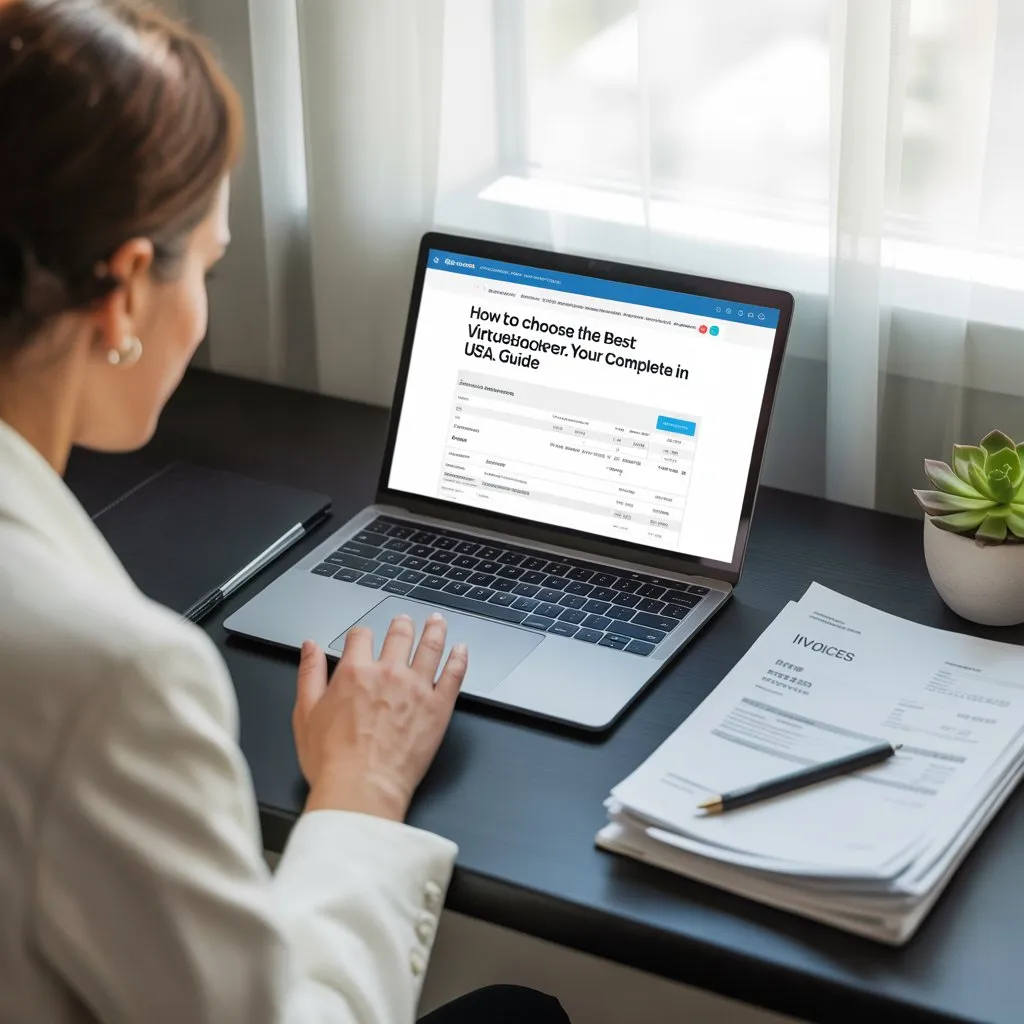

Financial Reporting and Analysis

Standard Financial Reports

- Profit and Loss statements

- Balance sheets

- Cash flow statements

- Budget vs. actual reports

- Accounts aging reports

Advanced Analytics

- Key performance indicator (KPI) tracking

- Trend analysis and forecasting

- Industry benchmarking

- Profitability analysis by product or service

- Custom reporting based on business needs

Payroll Management Services

Payroll Processing Features

- Employee pay calculation and processing

- Tax withholding and remittance

- Direct deposit management

- Pay stub generation

- Time tracking integration

Compliance Management

- Federal and state tax compliance

- Workers’ compensation reporting

- Unemployment insurance management

- New hire reporting

- Year-end tax form preparation (W-2s, 1099s)

Getting Started with Virtual Bookkeeping

Preparation Steps

- Gather historical financial records

- Choose compatible accounting software

- Define your service needs and budget

- Research potential providers

- Prepare questions for consultations

Implementation Process

- Initial consultation and needs assessment

- Service agreement and pricing confirmation

- Data migration and system setup

- Training and orientation sessions

- Ongoing communication establishment

Timeline Expectations

- Initial setup: 1-2 weeks

- Data migration: 1-3 weeks depending on complexity

- Full implementation: 2-4 weeks

- Monthly reporting schedule establishment

- Quarterly review meetings

Why Choose Rocket Bookkeeper for Your Business?

At Rocket Bookkeeper, we understand that every business has unique financial management needs. Our team of certified professionals provides comprehensive virtual bookkeeping services designed to help USA businesses thrive. We combine cutting-edge technology with personalized service to deliver accurate, timely financial management solutions.

Our Comprehensive Services Include:

- Complete bookkeeping and financial management

- Tax preparation and planning support

- Payroll processing and compliance

- Financial consulting and analysis

- Industry-specific expertise

- Dedicated account management

Why We Stand Out:

- Certified professionals with extensive experience

- Advanced security measures and data protection

- Transparent pricing with no hidden fees

- Scalable solutions that grow with your business

- Responsive customer service and support

- Proven track record of client success

Get Started Today

Ready to transform your business finances with professional virtual bookkeeping? Contact Rocket Bookkeeper today for a free consultation. Our team will assess your specific needs and provide a customized solution that fits your budget and business goals.

Conclusion

Choosing the right virtual bookkeeper is a crucial decision that can significantly impact your business’s financial health and operational efficiency. By considering factors such as certification, industry experience, technology compatibility, and communication style, you can find the perfect bookkeeping services to support your business goals.

Virtual bookkeeping services offer an excellent opportunity for businesses to access professional financial management without the overhead costs of full-time staff. Take time to evaluate your options carefully, and don’t hesitate to ask questions during the selection process.

The investment in quality virtual bookkeeping services pays dividends through improved financial accuracy, better decision-making capabilities, and the peace of mind that comes from knowing your finances are in professional hands. Whether you’re a startup looking for basic bookkeeping support or an established business needing comprehensive financial management, the right virtual bookkeeper can help you achieve your goals and drive business success.

Ready to streamline your financial management with professional virtual bookkeeping services? Contact qualified providers today to discuss your specific needs and discover how the right bookkeeping support can help your business grow and succeed in today’s competitive marketplace.