Accounting might seem overwhelming at first glance, but at its core are five fundamental principles that guide how businesses record and manage their financial activities. These principles are the building blocks of modern accounting frameworks and ensure consistency, accuracy, and transparency. Understanding them can give small business owners, aspiring bookkeepers, or anyone managing finances a significant edge in maintaining accurate records.

Whether you’re exploring virtual bookkeeping services pricing, considering QuickBooks Online Bookkeeping Service, or interested in learning how to maintain your own books effectively, this guide breaks down the five essential accounting principles in simple terms.

We’ll cover what these principles are, why they matter, and how they apply to your financial management needs.

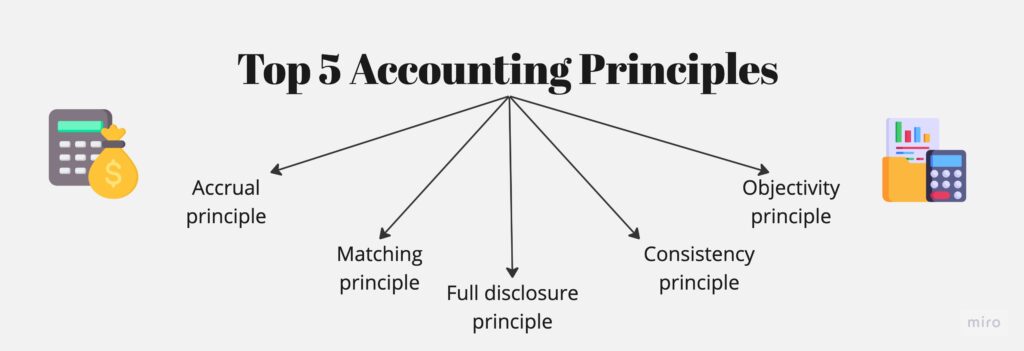

What Are the Five Basic Accounting Principles?

The five basic principles of accounting form the foundation of bookkeeping and financial reporting. They include the following:

- Revenue Recognition Principle

- Expense Recognition (Matching) Principle

- Historical Cost Principle

- Full Disclosure Principle

- Objectivity Principle

Each of them plays a vital role in ensuring that financial records provide a consistent and truthful representation of a business’s operations.

1. Revenue Recognition Principle

The revenue recognition principle governs when a business should recognize its income or revenue. According to this principle, income is recorded in the financial reports when it is earned, not when cash is received.

Example: If you run an online bookkeeping service and sign a contract with a client stating you’ll provide virtual bookkeeping services over the next six months, you only record revenue as the work is completed—not when the client pays upfront.

Why It Matters:

This principle ensures that businesses match revenue with performance, providing an accurate snapshot of earned income within a specific period. It’s especially crucial for businesses offering monthly bookkeeping services or subscriptions to match income to corresponding periods of service.

2. Expense Recognition (Matching) Principle

The expense recognition, or matching, principle states that expenses should be recorded in the same period as the revenue they help generate. Simply put, expenses are matched to the revenue they contributed to.

Example: Suppose your online bookkeeping service for small businesses incurs advertising expenses in May, and the ads generate new clients in June. The expense should be recorded in June, aligning with the revenue generated, rather than in May when the cost was incurred.

Why It Matters:

This principle ensures clarity in profitability and prevents an inaccurate representation of profits by matching expenses to the appropriate revenue periods.

3. Historical Cost Principle

The historical cost principle states that all assets should be recorded and reported based on their original purchase cost, rather than their current market value.

Example: If you purchase equipment such as computers for your office space at $5,000, you record the equipment at its purchase price, even if its value increases to $7,000 over time.

Why It Matters:

This principle minimizes guesswork and provides a clear, unchangeable benchmark for businesses to track expenses and balance. It’s especially essential for bookkeeping services near me or online to assess asset values accurately.

4. Full Disclosure Principle

The full disclosure principle requires businesses to disclose all relevant financial information that could impact decision-making by stakeholders or investors.

Example: If your QuickBooks Full Service Bookkeeping software is undergoing changes that might affect reporting accuracy, you should note this in your financial statements.

Why It Matters:

This principle ensures transparency in financial reporting, building trust with clients, investors, and regulatory bodies. For businesses utilizing online bookkeeping and tax service, this principle is vital to provide comprehensive and honest financial documentation.

5. Objectivity Principle

The objectivity principle focuses on ensuring that financial records and information are backed by verifiable and unbiased evidence. This means accountants should rely on objective data instead of subjective judgments while recording transactions.

Example: Instead of estimating income from your best online bookkeeping service, use actual client invoices as evidence.

Why It Matters:

Accurate data builds trust and confidence in your financial reporting. For anyone learning how to start an online bookkeeping service, this principle lays the groundwork for integrity in bookkeeping.

Why Understanding These Principles Is Essential

If you’re managing your own books or offering online bookkeeping and tax services, these principles are the foundation for staying compliant and maintaining clear financial records. They ensure that reporting is consistent, comparable, and trustworthy.

For small businesses, sticking to these principles can help streamline collaboration with accounting software like QuickBooks Online Bookkeeping Service or professional accounting firms. Additionally, they aid in tax filing, securing loans, and making sound financial decisions.

How to Apply Accounting Principles to Bookkeeping Services

Here’s how you can integrate these accounting principles into your bookkeeping practices effectively:

- Leverage Bookkeeping Software

Tools like QuickBooks Full Service Bookkeeping can seamlessly automate the application of these principles, from revenue recognition to matching expenses.

- Engage Virtual Bookkeeping Services

If maintaining records manually feels overwhelming, outsourcing tasks to the best online bookkeeping service new york city can keep your accounts accurate and up-to-date.

- Monitor Financial Returns

Apply the principles to review monthly reports carefully. Whether you’re subscribing to online bookkeeping services for small businesses or managing the books for a growing enterprise, accurate recordkeeping leads to smarter decisions.

- Transparency and Reporting

If you’re offering a quickbooks online bookkeeping service, ensure transparency with your clients. Use clear reporting to show compliance with the full disclosure and objectivity principles.

Elevate Your Bookkeeping Accuracy

Now that you’ve explored the basics of accounting principles, implementing them doesn’t need to be intimidating. Whether you run a business or specialize in monthly bookkeeping services, these principles empower you to organize finances well and plan with confidence.

If tackling bookkeeping feels like a challenge, consider professional help. Subscribing to an online bookkeeping service San Francisco ensures compliance with these principles, streamlines financial management, and leaves more time for running your business.

Want to learn more about simplified financial management? Check out how QuickBooks Full Service Bookkeeping and virtual bookkeeping services pricing packages can benefit your company today.