Every small business in San Francisco (and across the USA) needs a clear financial picture. A well-structured balance sheet helps you understand your company’s assets, liabilities, and equity in one place. That’s why our expert bookkeepers at Rocket Bookkeeper created a free balance sheet template you can download and start using today.

✅ Get Your Free Balance Sheet Template

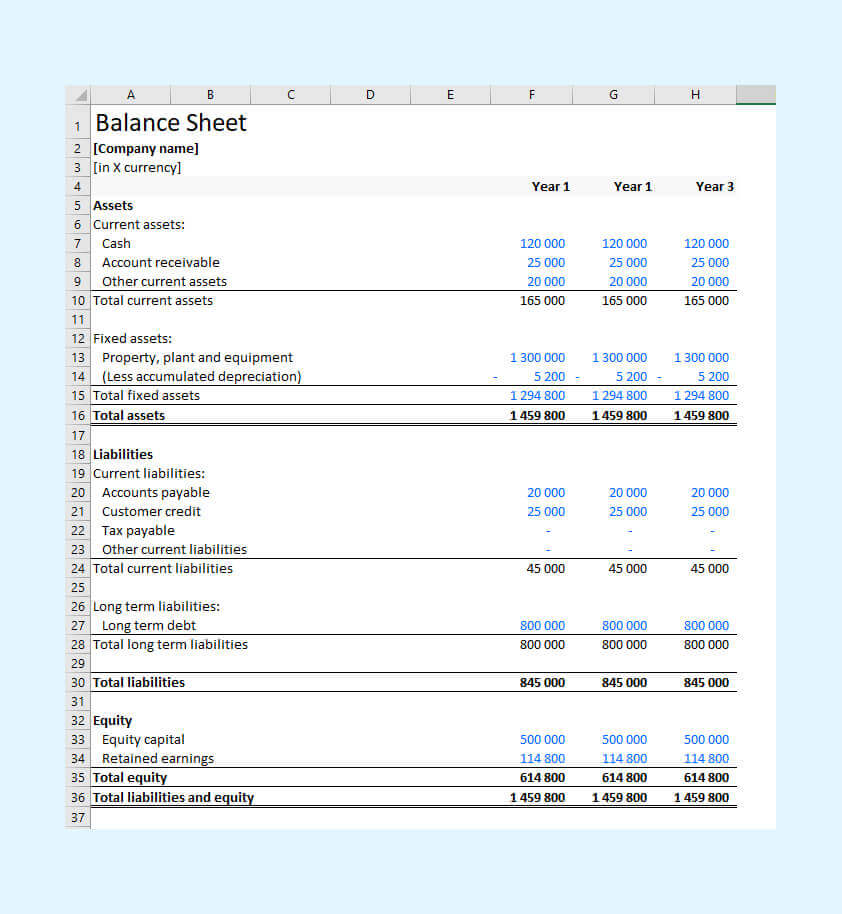

Enter your details below and we’ll send you an Excel balance sheet template that makes tracking your business finances simple.

What Is a Balance Sheet?

A balance sheet is like a snapshot of your business’s financial position. It shows what your business owns (assets), what it owes (liabilities), and what’s left over for the owner (equity) at any given time.

It follows the simple but powerful formula:

Assets = Liabilities + Equity

By keeping your balance sheet updated, you’ll always know your true financial standing, making it easier to plan, grow, and communicate with lenders or investors.

The 3 Key Parts of a Balance Sheet

1. Assets

Assets are everything your business owns that has value.

- Current Assets: Cash, accounts receivable, prepaid expenses, and inventory.

- Fixed Assets: Property, vehicles, buildings, and equipment.

Together, these give you the total value of what your business owns.

2. Liabilities

Liabilities are what your business owes.

- Current Liabilities: Accounts payable, credit card balances, payroll, and short-term loans.

- Long-Term Liabilities: Mortgages, equipment leases, and long-term loans.

3. Equity

Equity is your share of the business after paying off debts. It includes:

- Owner’s equity

- Retained earnings

- Contributed capital

Equity = your company’s net worth.

Why Balance Sheets Matter for Small Businesses in San Francisco

- Track Business Growth: Monthly or quarterly updates let you see progress and spot trends.

- Investor-Ready: Lenders and investors want to see proof of financial stability.

- Manage Cash Flow: Helps identify upcoming obligations and avoid financial surprises.

- Simplify Tax Prep: A clear record makes filing taxes easier and more accurate.

How to Use Rocket Bookkeeper’s Balance Sheet Template

- List all your assets in the right categories.

- Record your liabilities.

- Calculate equity using the accounting formula.

- Verify that Assets = Liabilities + Equity.

That’s it! With this simple process, you’ll always know your financial position.

👉 Download the Free Balance Sheet Template

Dos and Don’ts for Using Balance Sheets

✅ Do:

- Keep your bookkeeping accurate.

- Update regularly (monthly or quarterly).

- Include all assets and liabilities.

- Work with a professional bookkeeper if you’re short on time.

❌ Don’t:

- Forget small liabilities.

- Mix personal and business finances.

- Skip updates for months.

- Confuse a balance sheet with an income statement.

Get Started Today

Ready to get organized? Download your free balance sheet template today and take control of your small business finances.

Need professional help? Rocket Bookkeeper provides expert bookkeeping services in San Francisco and across the USA — including balance sheets, income statements, cash flow tracking, and more.

📞 Contact us today to see how we can support your financial success.