Managing your books is one thing — preparing accurate tax filings is another. When financial records aren’t updated or tax documents are incomplete, small businesses risk IRS penalties, missed deductions, and unnecessary stress.

Rocket Bookkeeper provides a complete Bookkeeping & Tax Preparation solution designed for U.S. small businesses and startups. We keep your books clean, your financials organized, and your tax filings accurate so you stay compliant year-round.

Our team ensures your financial records are IRS-ready, deductions are maximized, and taxes are filed correctly and on time.

On sign up, your success manager learns about your business, gives you a tour, finds answers and helps connect your financial accounts. Banks, credit cards, and yes, QuickBooks too.

Every week, your personal bookkeeper highlights transactions that needs your attention. All it takes is a click to comment, attach files or jump on a call. Voila, clean books.

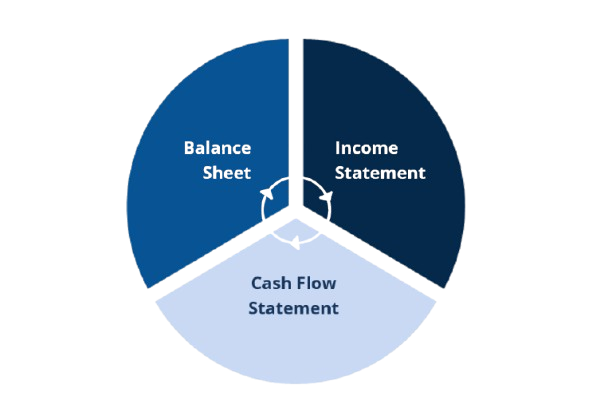

Whether you operate on cash-basis or accruals, your bookkeeper reconciles and closes your books by the 15th of every month and prepares your financial statements.

With weekly financial summaries and a real-time view of income, expenses and profits, you can now track bills and overdue invoices, even securely pay your bills, all in rocketbookkeeper.

✅ Affordable bookkeeping services starting at $299/month

✅ 100% U.S.-based team of CPAs & QuickBooks ProAdvisors

✅ Specialized in QuickBooks bookkeeping service integration

✅ Catch-up bookkeeping to fix months or years of backlog

✅ Serving all 50 states, with dedicated support in Los Angeles, New York, Houston, and Chicago

✅ Secure & compliant – SOC 2, GDPR, IRS standards

Upon signing up, your success manager will learn about your business, guide you through the platforms, provide solutions, and assist in connecting your financial accounts, including banks, credit cards, and QuickBooks.

Each week, your dedicated bookkeeper flags any transactions that need your input. With just a click, you can comment, upload files, or hop on a call. And just like that, your books are in order.

Whether you follow cash or accrual accounting, your bookkeeper reconciles and closes your books by the 15th of each month and delivers your financial statements.

With weekly financial summaries and real-time insights into your income, expenses, and profits, you’ll have full control to track bills, manage overdue invoices, and securely pay bills—all within your accounting software.

Whether you’re behind a few months or even years, your Rocket bookkeeping team can help you catch up real quick and keep your finances organized.

Financial insights designed for fast-moving businesses. From fundraising to forecasting—we deliver the reports that fuel growth.

We connect your QuickBooks or Xero, sync bank accounts, and review your financial history to ensure everything is organized for accurate monthly bookkeeping and smooth tax preparation.

Your dedicated U.S.-based bookkeeper categorizes expenses, reconciles accounts, and keeps your books updated each month—ensuring your financial records stay clean and IRS-ready.

We monitor deductible expenses, track tax-related activity, and prepare the documents you’ll need for business tax filing—helping you reduce your tax burden legally.

At tax time, we prepare your federal and state business tax returns, submit the required filings, and ensure your reports meet IRS compliance standards—without last-minute stress.

Ongoing, reliable bookkeeping

clear old backlogs quickly

invoices, bills, and vendor management

setup, optimization, and support

Categorizing expenses, reconciling bank statements, and ensuring accurate monthly records.

Helping businesses manage payroll-related bookkeeping seamlessly each month.

Preparing monthly profit and loss reports, balance sheets, and cash flow summaries.

Helping owners understand where money is going and how revenue is growing.

Rocket Bookkeeper understands every industry faces unique challenges. That’s why we offer tailored bookkeeping solutions for U.S. businesses:

We proudly serve businesses nationwide USA, but provide specialized support in major business hubs:

No matter where you are in the USA, our remote bookkeeping services deliver accuracy, compliance, and speed.

Rocket Bookkeeper makes bookkeeping simple, transparent, and affordable:

Custom plans for businesses with $10K – $500K+ in monthly expenses

Maintained IRS compliance for Series A fundraising

“Rocket Bookkeeper keeps our books spotless and IRS-ready. They’re a game-changer for our startup.”

“Affordable, reliable, and professional. The best outsourced bookkeeping service in the USA.”

“Finally, a bookkeeping service that understands small businesses. Simple, accurate, and stress-free.”

Your financial data is safe with Rocket Bookkeeper:

Here are some common queries about our monthly bookkeeping services

Yes. Rocket Bookkeeper exclusively serves small businesses, startups, and entrepreneurs across the United States.

No worries! Our catch-up bookkeeping service can quickly bring your books up to date—even if you’re months or years behind. We’ll organize everything accurately so you’re IRS-ready and stress-free.

Absolutely. We are a certified QuickBooks bookkeeping service provider for U.S. businesses.

Pricing starts at $299/month with flat-rate billing and no hidden fees.

Yes. We use SOC 2, GDPR, and 256-bit encryption to keep your data 100% secure.

Yes — we prepare and file federal, state, and local business tax returns, ensuring your books are accurate, your deductions are tracked, and your filings meet IRS requirements.

Stop losing time on bookkeeping. Let Rocket Bookkeeper handle your finances while you focus on scaling your business.

Copyright © 2025 Rocket Bookkeeper. All Rights Reserved.