If you’re searching for the right bookkeeping software for your business, you’ve likely noticed the sheer number of tools available. Some are designed for freelancers, while others offer robust features for entire accounting departments. How can you be sure which one is right for your company?

This guide will help you navigate the crowded market. We’ll explore common questions about bookkeeping software and then review 22 popular options, highlighting who they’re best for. By the end, you’ll have a clearer path to selecting the perfect tool for your needs.

Bookkeeper vs. Bookkeeping Software: What’s the Difference?

It’s important to understand the distinction between a bookkeeper and the software they use.

Bookkeeping is the process of recording and managing your company’s financial transactions. Bookkeeping software is the tool that helps a business owner or a professional bookkeeper manage that data efficiently.

A bookkeeper is the person responsible for this task. While their duties can vary, they generally perform four key services:

- Categorize transactions from bank accounts, credit cards, and payment processors.

- Prepare key financial statements, including the profit and loss statement, balance sheet, and statement of cash flow.

- Reconcile bank statements with your company’s transaction records to ensure accuracy.

- Manage accounts receivable and payable, overseeing money coming in and going out.

Good bookkeeping software simplifies these tasks. Many tools connect directly to your bank accounts to import transactions automatically. This not only saves time but also significantly reduces the risk of human error that comes with manual data entry.

Bookkeeping vs. Accounting Software: How to Tell Them Apart

The lines between bookkeeping and accounting software are often blurred, as most platforms can handle tasks for both roles. The main difference lies in how bookkeepers and accountants use the software.

Bookkeepers focus on recording financial transactions, maintaining accurate records, and balancing the books. They manage the day-to-day financial data of a business.

Accountants take this data and use it for higher-level analysis. Their work includes strategic planning, tax preparation, and creating in-depth financial reports. Accountants are certified professionals qualified to provide financial advice.

In short, bookkeepers manage the financial information, while accountants interpret it to provide strategic guidance. Both professionals rely on software to perform tasks like:

- Managing accounts payable and receivable

- Categorizing transactions

- Preparing financial statements

- Handling purchase orders and inventory

- Reconciling bank accounts

Should I Use Paid or Free Bookkeeping Software?

Paid software almost always offers more features and greater functionality than free alternatives. However, free software can be a good starting point for certain businesses.

For example, platforms like Wave offer free accounting, invoicing, and receipt scanning. These tools are often sufficient for freelancers or very small businesses with simple financial needs. Most growing companies, however, will benefit from a paid solution that provides more advanced features, better support, and the ability to scale.

How to Choose the Right Bookkeeping Software

The best way to choose your software is to identify the specific challenges your business needs to solve.

A freelancer might prioritize simple invoicing and payment processing. A large enterprise will need a powerful system that supports multiple users and complex financial operations. A startup should look for a scalable solution that can grow with the business.

To help you decide, here is a list of 22 popular bookkeeping software tools.

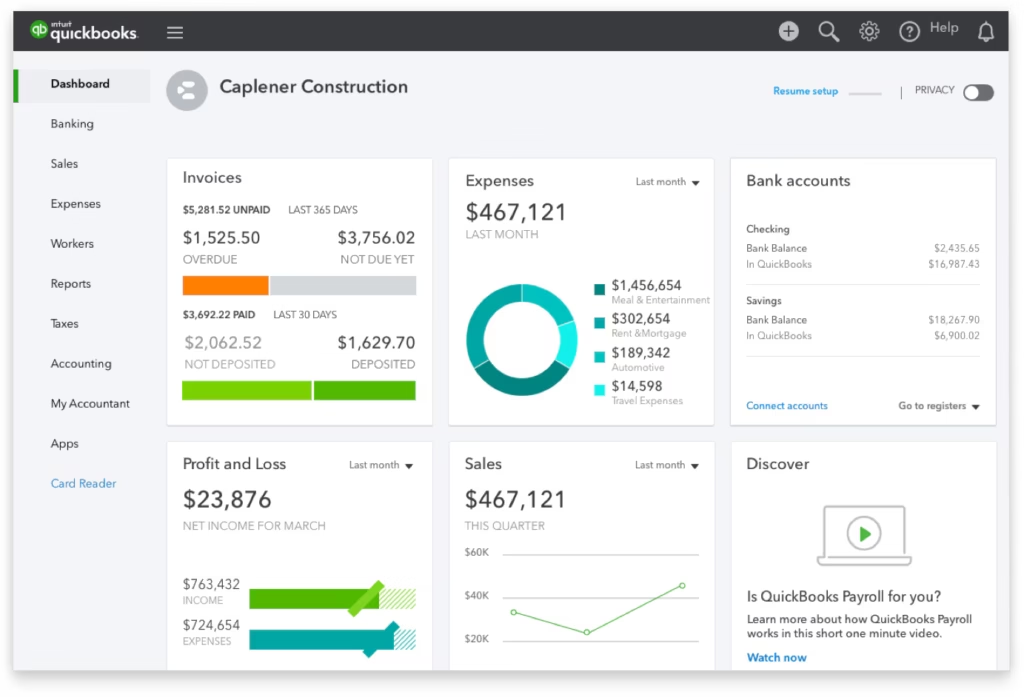

1. QuickBooks Online

- Pricing: 30-day free trial. Plans start at $30/month.

- Rating: 4.3/5 on G2

- Who it’s for: Businesses of all sizes, from small to enterprise. It’s particularly great for startups due to its scalability.

- Key Features: QuickBooks Online is a market leader for a reason. It’s a versatile, all-in-one platform for organizing expenses, managing sales, and preparing for taxes. Its customizable dashboard and extensive reporting capabilities provide a clear view of your finances. It also integrates with hundreds of third-party apps like PayPal and Square.

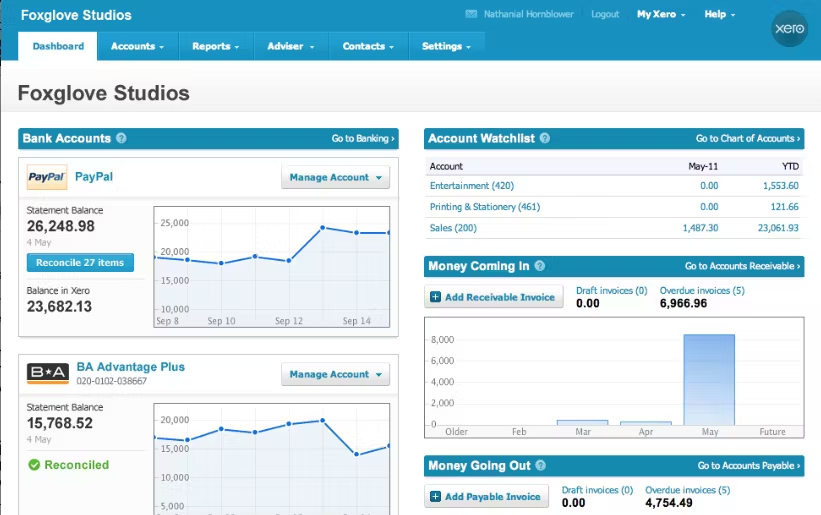

2. Xero

- Pricing: Plans start at $15/month.

- Rating: 4.4/5 on G2

- Who it’s for: Small to medium-sized businesses looking for a comprehensive cloud accounting solution.

- Key Features: Xero offers robust features, including inventory management, purchase orders, and double-entry accounting. It allows you to add online payment options to invoices (via Stripe, PayPal, or Apple Pay) and automatically logs the transactions.

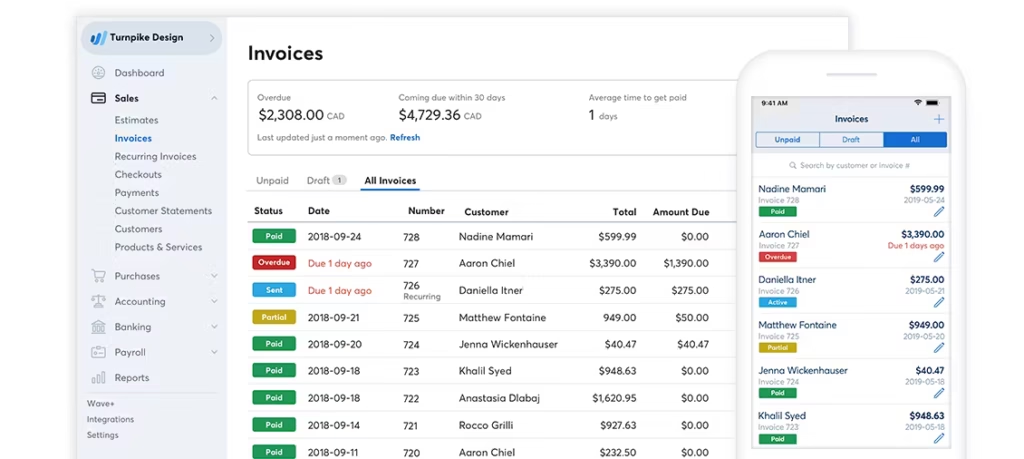

3. Wave

- Pricing: Accounting, invoicing, and receipt scanning are free. Pay-per-use for payment processing and payroll.

- Rating: 4.4/5 on G2

- Who it’s for: Freelancers and small businesses needing basic, free accounting tools.

- Key Features: Wave provides essential accounting functions without the cost. You can link bank accounts, generate financial reports, and manage invoices. The paid features for payment processing and payroll are competitively priced, making it a great entry-level option.

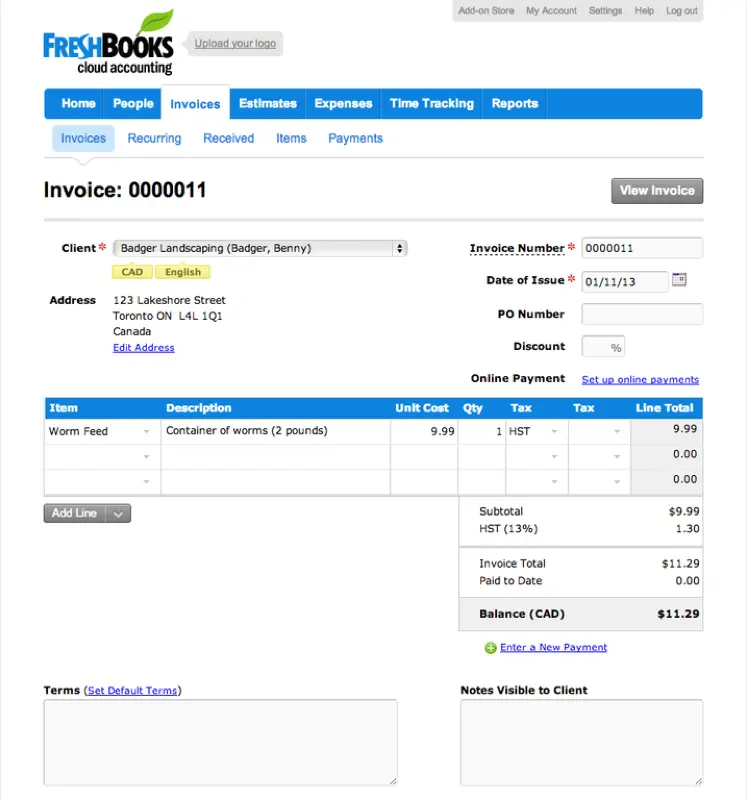

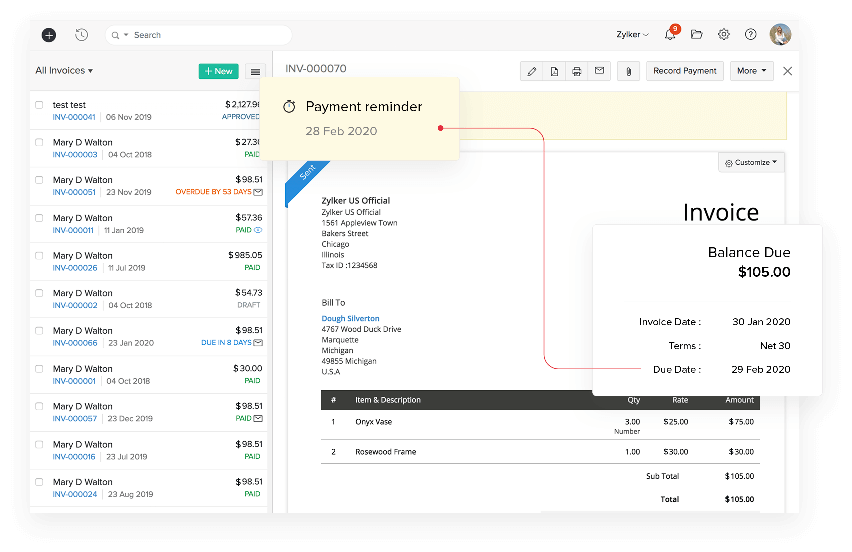

4. FreshBooks

- Pricing: 30-day free trial. Plans start at $19/month for up to 5 clients.

- Rating: 4.5/5 on G2

- Who it’s for: Solopreneurs, freelancers, and small service-based businesses.

- Key Features: FreshBooks excels at invoicing, time tracking, and expense management. It’s known for its user-friendly interface that simplifies the accounts receivable process. Clients can pay invoices directly via credit card.

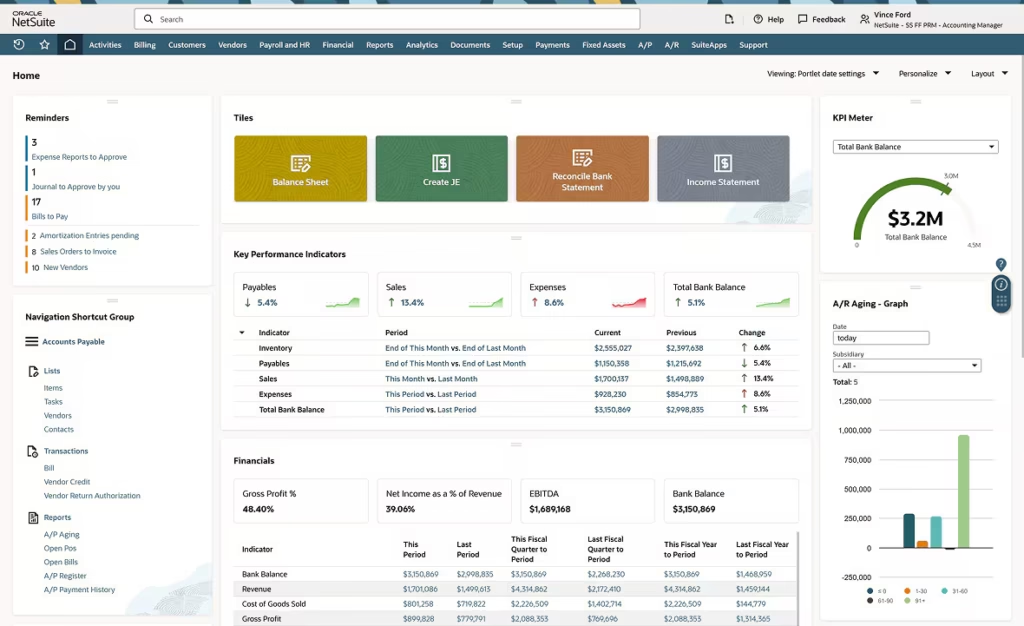

5. NetSuite ERP

- Pricing: Contact for pricing.

- Rating: 4.0/5 on G2

- Who it’s for: Medium to enterprise-level companies.

- Key Features: NetSuite is a powerful cloud-based Enterprise Resource Planning (ERP) system. It offers highly customizable tools for financial management, inventory tracking, revenue recognition, and more. It’s designed to run an entire business, not just the accounting department.

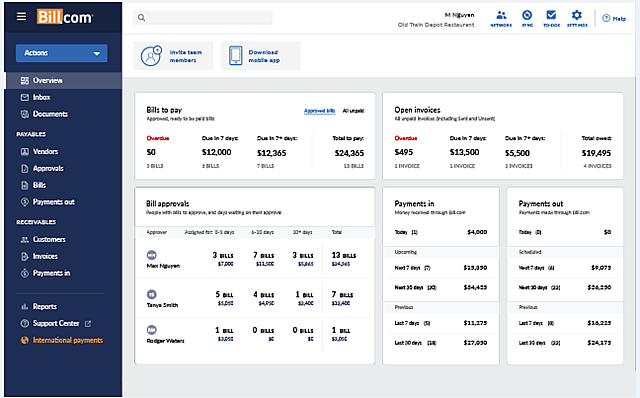

6. Bill.com

- Pricing: Plans start at $45/user/month.

- Rating: 4.3/5 on G2

- Who it’s for: Businesses of any size seeking to automate accounts payable and receivable.

- Key Features: Bill.com automates tedious payment processes. It integrates with QuickBooks, Xero, and other platforms to sync data and eliminate manual entry. It can even send paper checks to vendors on your behalf.

7. Sage 50cloud

- Pricing: Plans start around $60/month.

- Rating: 4.1/5 on G2

- Who it’s for: Small and medium-sized businesses.

- Key Features: Sage 50cloud combines the reliability of desktop accounting with cloud connectivity. It offers features for cash flow management, invoicing, budgeting, and tax compliance. It’s a comprehensive solution that also includes payroll and credit card processing.

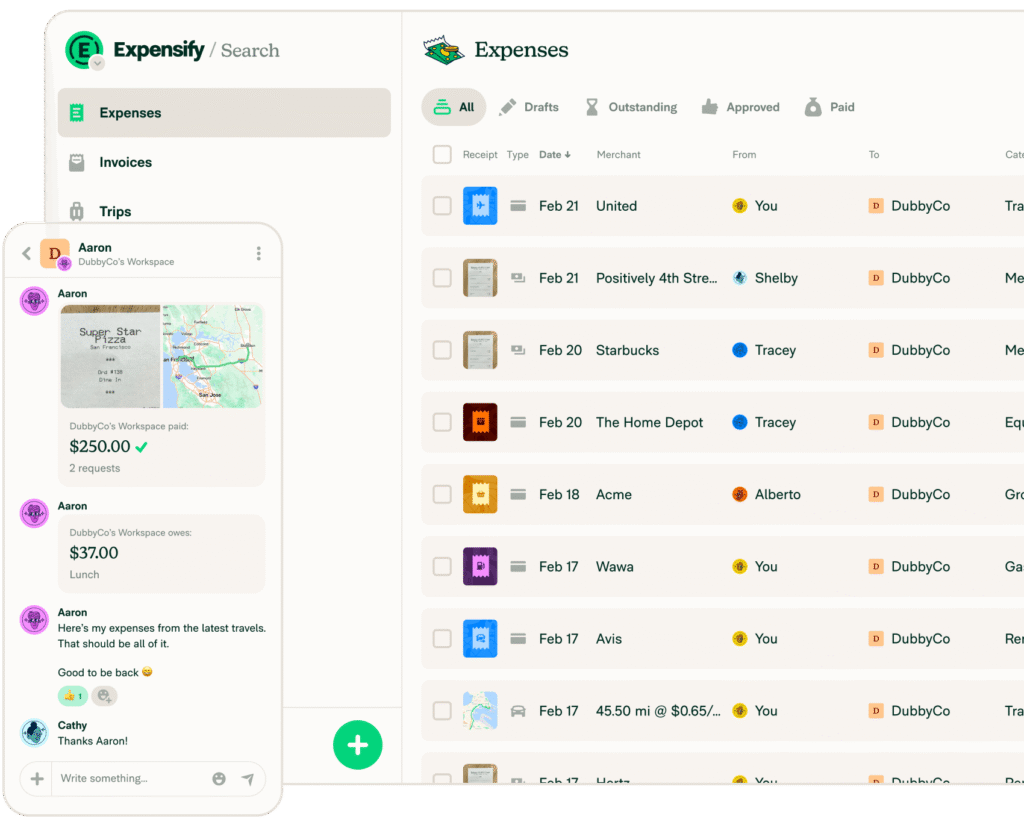

8. Expensify

- Pricing: Plans start at $5/user/month.

- Rating: 4.5/5 on G2

- Who it’s for: Individuals and businesses needing to track expenses and manage receipts.

- Key Features: Expensify simplifies expense reporting. Snap a photo of a receipt, and its SmartScan technology automatically extracts the details. It streamlines the reimbursement process and integrates with major accounting software.

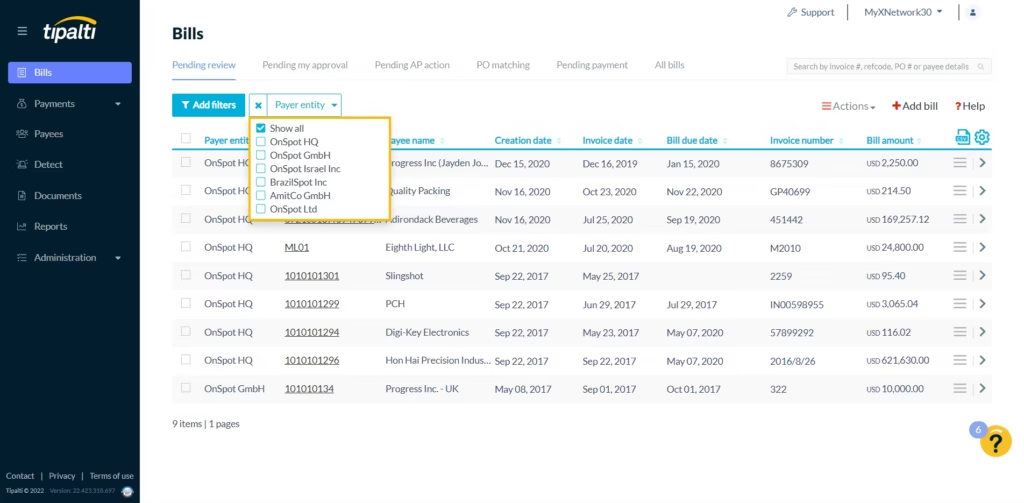

9. Tipalti

- Pricing: Contact for pricing.

- Rating: 4.6/5 on G2

- Who it’s for: Mid-sized and enterprise companies that handle large volumes of global payments.

- Key Features: Tipalti automates the entire accounts payable process, from onboarding suppliers to processing mass payments across 196 countries. It has strong fraud detection and tax compliance features, saving finance teams significant time.

10. Zoho Books

- Pricing: Free plan available. Paid plans start at $15/month.

- Rating: 4.6/5 on G2

- Who it’s for: Small to large businesses needing a full-featured online accounting system.

- Key Features: Zoho Books is an end-to-end accounting solution that helps manage invoices, track expenses, and automate workflows. It integrates seamlessly with other Zoho apps, creating a powerful business management ecosystem.

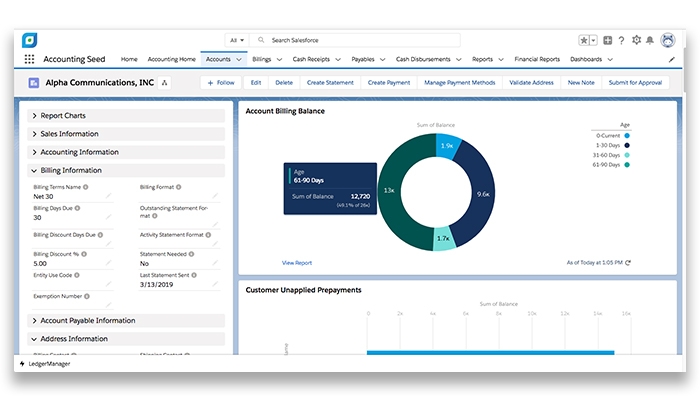

11. Accounting Seed

- Pricing: Contact for pricing.

- Rating: 4.4/5 on G2

- Who it’s for: Businesses of all sizes that use Salesforce.

- Key Features: Built natively on the Salesforce platform, Accounting Seed offers a flexible and customizable accounting solution. It provides real-time financial data and connects accounting with your CRM, eliminating data silos.

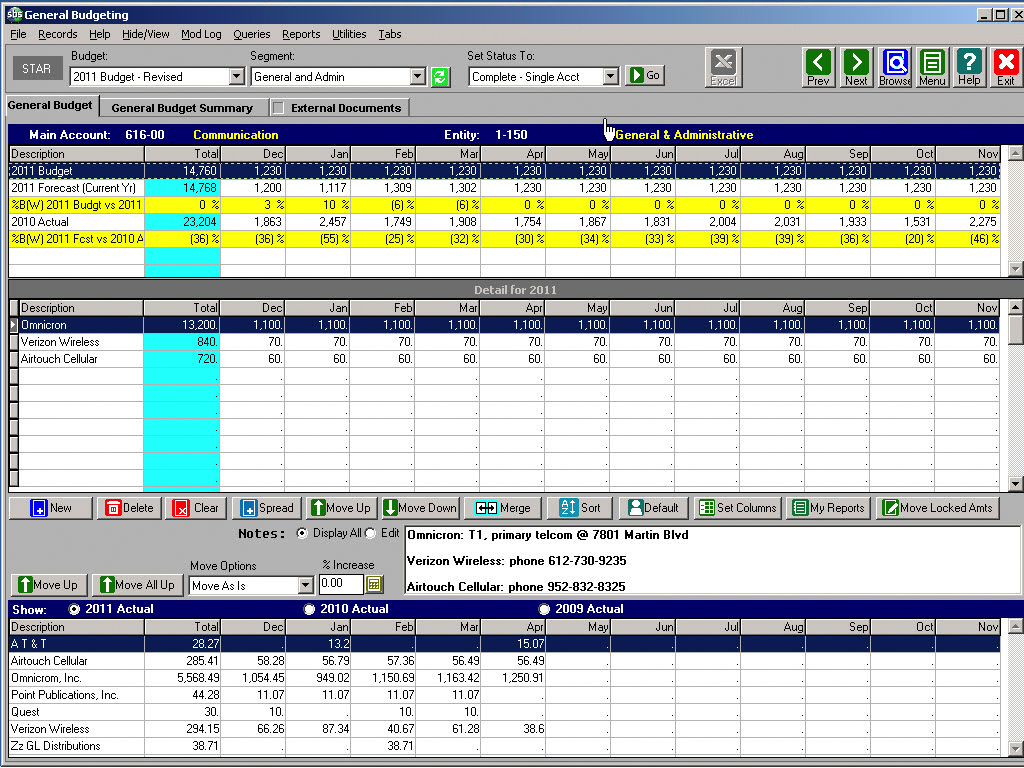

12. SBS (Software Business Systems)

- Pricing: Contact for pricing.

- Rating: 4.2/5 on Capterra

- Who it’s for: Companies needing an integrated suite for financials, payroll, purchasing, and HR.

- Key Features: SBS offers a suite of modules that can manage core financials, project costing, and human resources. It integrates with QuickBooks for easy data export, reducing manual entry errors.

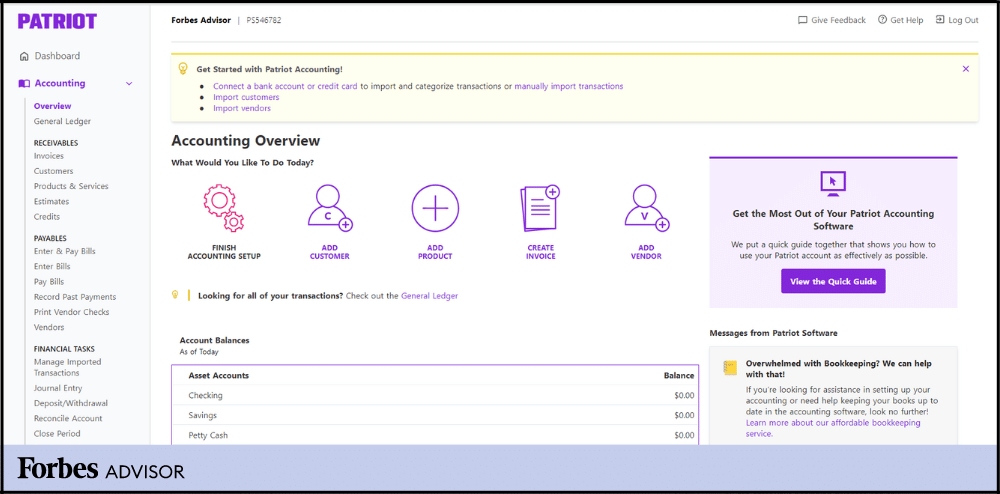

13. Patriot Accounting

- Pricing: 30-day free trial. Plans start at $24/month.

- Rating: 4.8/5 on G2

- Who it’s for: Small and medium-sized businesses needing straightforward accounting and payroll software.

- Key Features: Patriot is known for its simplicity and excellent customer support. The software allows you to track income, manage expenses, create invoices, and run payroll with ease.

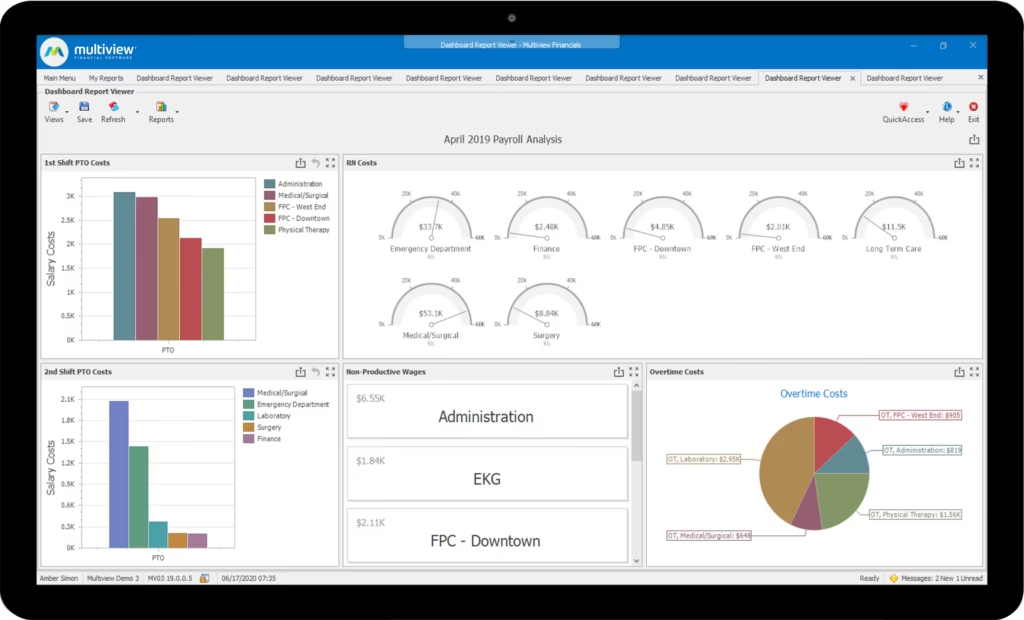

14. Multiview ERP

- Pricing: Contact for pricing.

- Rating: 4.4/5 on G2

- Who it’s for: Companies in industries like healthcare, finance, and education seeking a scalable ERP solution.

- Key Features: Multiview is a cloud ERP system that provides powerful reporting, budgeting, and forecasting tools. It helps businesses gain deep insights into their financial data to make better decisions.

15. Canopy

- Pricing: Modular pricing based on features chosen.

- Rating: 4.6/5 on G2

- Who it’s for: Accounting and tax firms.

- Key Features: Canopy is a practice management platform designed for tax professionals. It helps automate workflows, manage client communications, and securely exchange documents through a client portal, streamlining tax season.

16. Plus & Minus

- Pricing: Starts at $1,000 per user.

- Rating: 4.4/5 on G2

- Who it’s for: Businesses needing a comprehensive accounting/ERP platform.

- Key Features: Plus & Minus is a full-service accounting software with modules for AP, AR, payroll, inventory, and cash management. It also supports job costing and multi-currency transactions.

17. OneUp

- Pricing: 30-day free trial. Plans start at $9/month.

- Rating: 4.4/5 on G2

- Who it’s for: Small businesses that want to automate their bookkeeping.

- Key Features: OneUp connects to your bank account and uses AI to learn and automate transaction categorization. It also features modules for invoicing, inventory, and CRM, making it an all-in-one tool for small business owners.

18. Sage Intacct

- Pricing: Contact for pricing.

- Rating: 4.4/5 on G2

- Who it’s for: Growing small and mid-sized companies.

- Key Features: Sage Intacct is a powerful cloud financial management platform. It excels at multi-entity consolidation, project accounting, and revenue recognition. It is the only accounting software preferred by the AICPA.

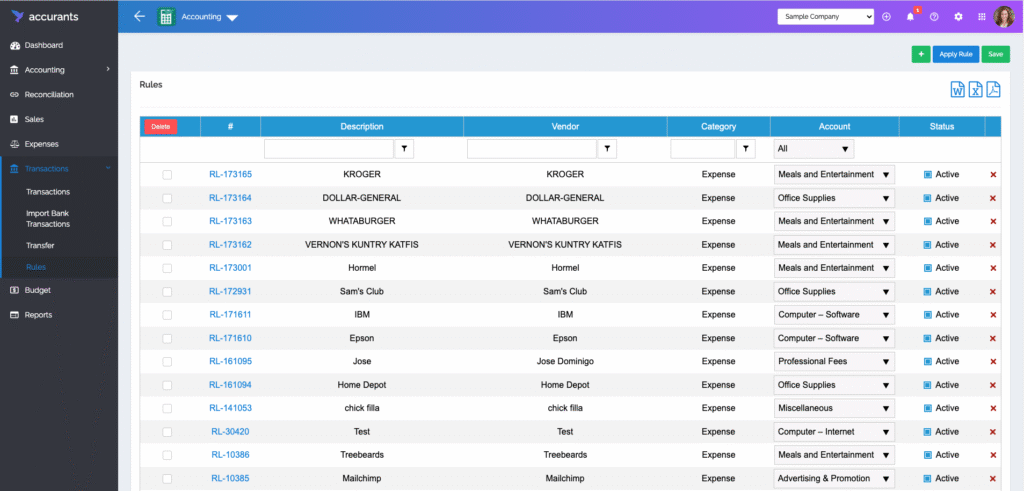

19. Accurants

- Pricing: Free for one user. Paid plans start at $25/month.

- Rating: 3.4/5 on G2

- Who it’s for: Small businesses looking for an all-in-one system with CRM and project management.

- Key Features: Accurants combines accounting with CRM, invoicing, project management, and time tracking. It aims to eliminate the need for multiple software subscriptions by providing a single platform to run a business.

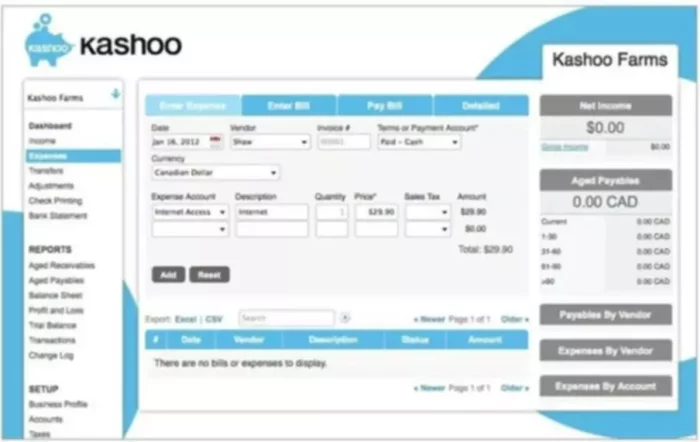

20. Kashoo

- Pricing: 14-day free trial. Plans start at $30/month.

- Rating: 4.5/5 on G2

- Who it’s for: Small business owners who value simplicity and ease of use.

- Key Features: Kashoo is designed for users without an accounting background. It uses machine learning to automatically categorize transactions and offers simple invoicing, payment processing, and reporting.

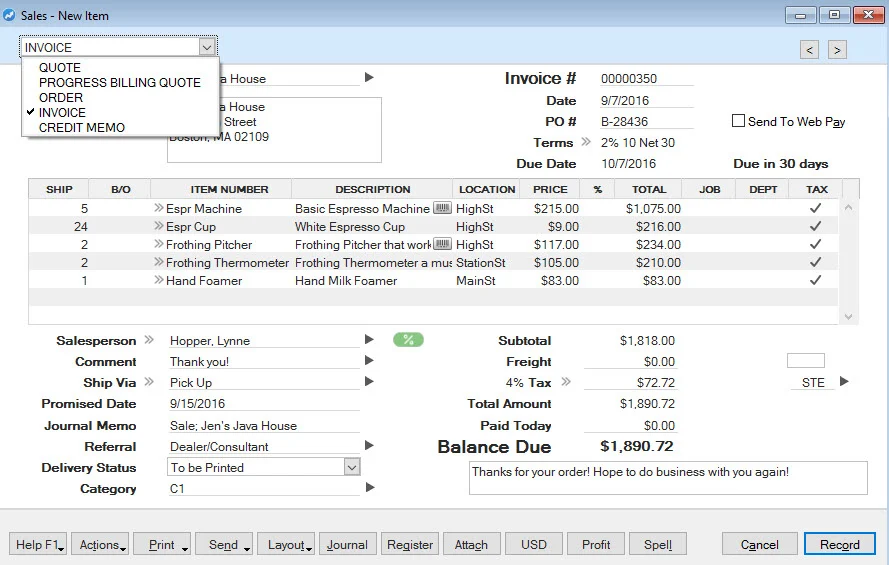

21. AccountEdge Pro

- Pricing: One-time purchase starting at $499.

- Rating: 4.2/5 on G2

- Who it’s for: Small businesses that prefer desktop software over a cloud-based solution.

- Key Features: AccountEdge Pro is a desktop accounting program that offers an extra layer of security since data is stored locally. It includes features for banking, sales, time billing, purchases, and payroll.

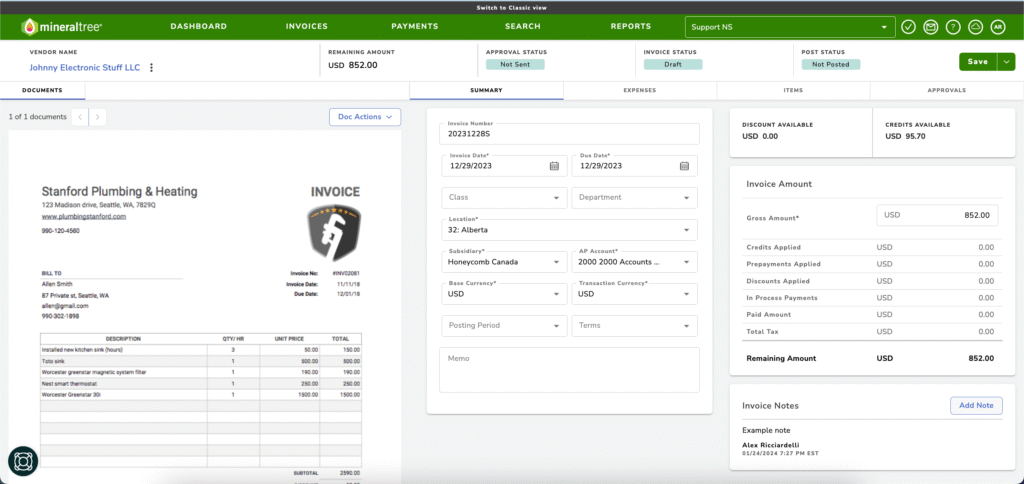

22. MineralTree

- Pricing: Contact for pricing.

- Rating: 4.5/5 on G2

- Who it’s for: Mid-market and enterprise companies with a high volume of monthly payments.

- Key Features: MineralTree automates the entire accounts payable process, from invoice capture to payment execution. It offers strong security features, including two-factor authentication and payment limits, to guard against fraud.

Take the Guesswork Out of Your Bookkeeping

Finding the right software is a big step, but it’s only part of the solution. Even the best tools can’t replace the expertise and insight of a professional bookkeeper. If you feel overwhelmed by the options or simply want to free up your time, you’re not alone.

At Rocket Bookkeeper, we handle your bookkeeping from start to finish. Our team of experts uses powerful software to ensure your financials are accurate, tax-ready, and delivered on time. You get peace of mind and more time to focus on what you do best—growing your business.

Ready to hand off your bookkeeping? Get started with Rocket Bookkeeper today.